The Power Of Attorney England is a legal document that grants an individual or entity the authority to make decisions on behalf of another person, known as the donor or grantor. This authorization is typically established when the donor is of sound mind and able to make informed decisions about who they want to appoint as their attorney. The primary purpose of a Power of Attorney is to ensure that someone trustworthy and capable is designated to manage the donor’s affairs if they become unable to do so themselves due to illness, injury, or other circumstances.

Having a Power of Attorney in place is highly beneficial for several reasons. Firstly, it provides peace of mind to the donor, knowing that their financial, legal, and healthcare matters will be handled by a trusted individual or entity according to their wishes. In case of incapacity, having a designated attorney can streamline decision-making processes and ensure that timely and appropriate actions are taken on behalf of the donor.

Moreover, a Power of Attorney can help avoid potential disputes or conflicts among family members regarding decision-making authority. It provides clear legal documentation of the donor’s intentions and instructions, reducing ambiguity and uncertainty during challenging times. Additionally, a well-crafted Power of Attorney can contribute to efficient estate planning, asset management, and healthcare management, safeguarding the donor’s interests and ensuring continuity of care and financial stability. Overall, the importance of having a Power of Attorney lies in its ability to empower individuals to plan for unforeseen circumstances and protect their interests and well-being.

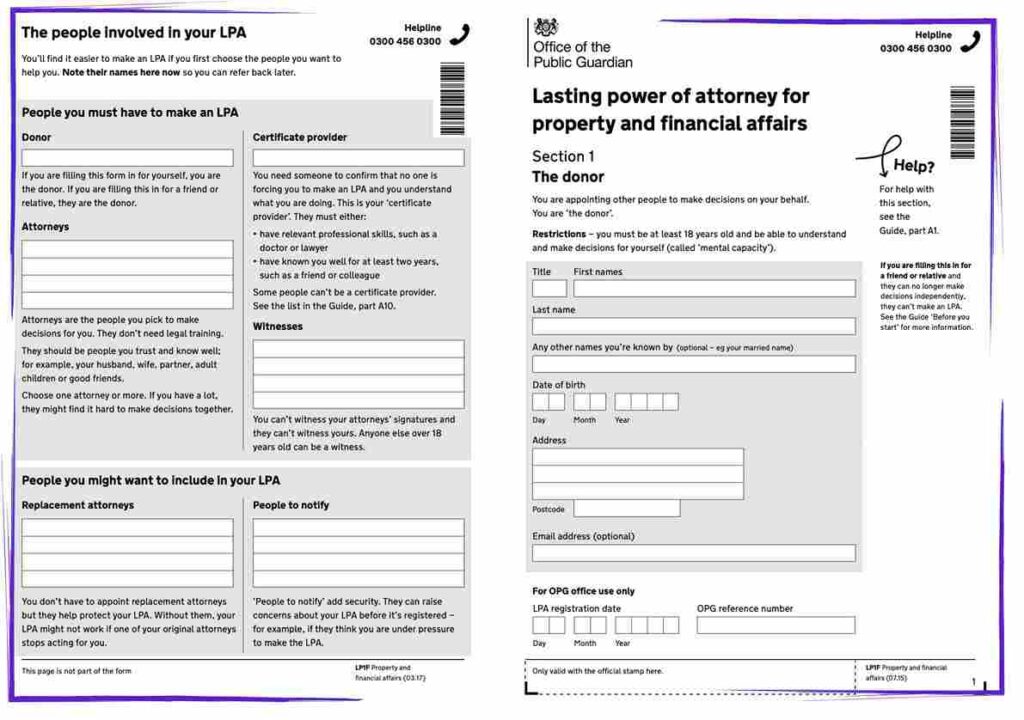

Power Of Attorney England

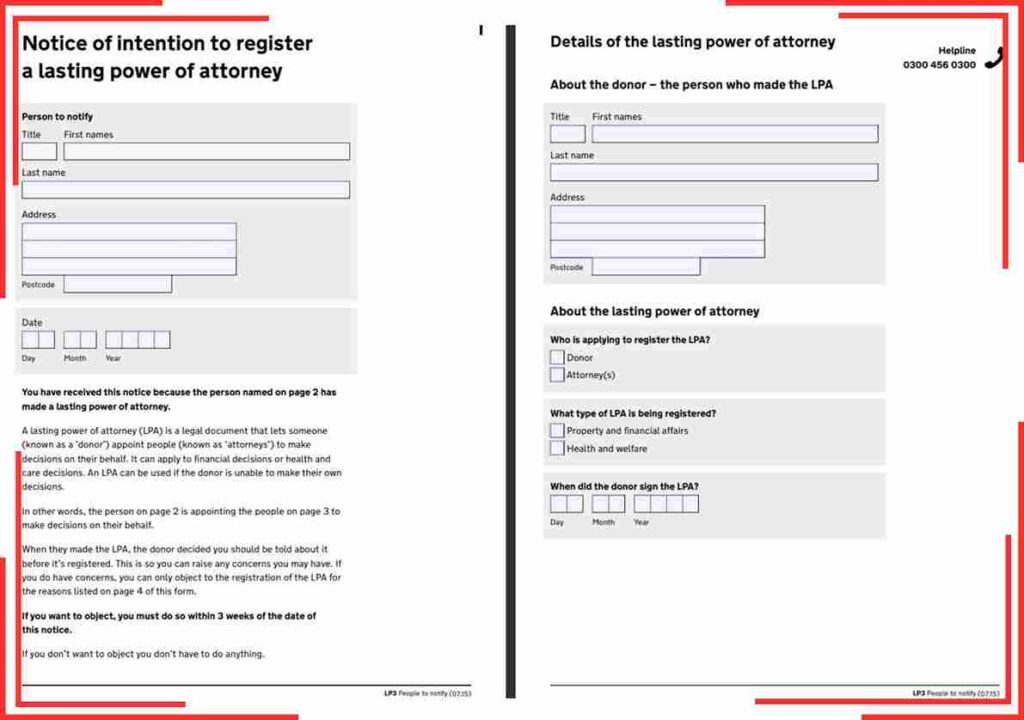

LPA Form To Notify People England

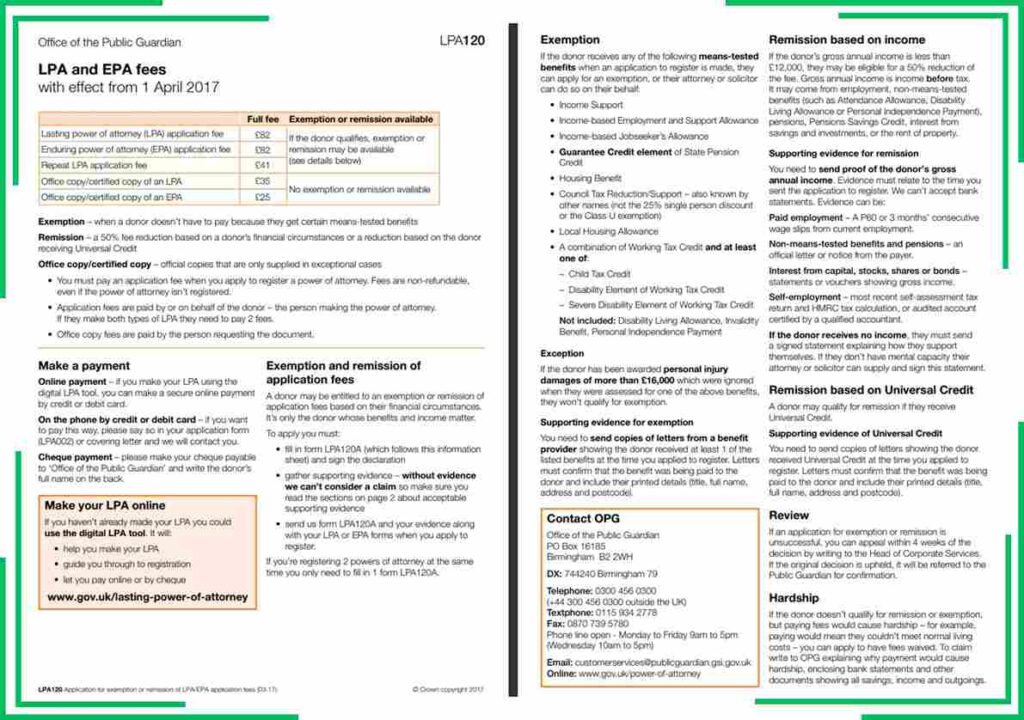

Cost of Power of Attorney in England

Cost of Power of Attorney in England

Lasting Power of Attorney Forms England

Hello, I’m Inna Evdokimova, an IP Lawyer and Patent Attorney based in the United Kingdom. With a passion for intellectual property law, I specialize in providing expert guidance and legal representation to clients navigating the complexities of patent law in the UK.

With years of experience in the field, I’ve cultivated a deep understanding of the intricacies of intellectual property rights, empowering individuals and businesses alike to protect their innovations and creations effectively.

Through my website, powerofattorneyuk.uk, I aim to serve as a valuable resource for those seeking clarity and assistance in matters of patent law and intellectual property rights. Whether you’re looking to secure a patent for your invention or require guidance on IP-related legal issues, my mission is to provide you with personalized, reliable solutions tailored to your unique needs.

I’m dedicated to helping my clients safeguard their intellectual property assets and navigate the legal landscape with confidence. With a commitment to excellence and client satisfaction, I strive to deliver results-driven strategies and advocacy that exceed expectations.

I look forward to the opportunity to assist you on your intellectual property journey and help you unlock the full potential of your innovations.