When considering a Power of Attorney, one crucial aspect to take into account is the associated Power of Attorney Cost. The cost of establishing a POA can vary significantly based on several factors, including the type of POA, geographic location, legal professional’s fees, complexity of the situation, and additional services required. A Power of Attorney (POA) is a legal document that grants someone the authority to act on behalf of another person in specific legal or financial matters. The person granting this authority is known as the “principal” or “grantor,” while the individual receiving the authority is called the “attorney-in-fact” or “agent.” This authorization can be broad, covering various aspects of the principal’s affairs, or limited to specific tasks or periods.

The importance of a Power of Attorney cannot be overstated, especially in situations where the principal becomes incapacitated due to illness, injury, or old age. Without a POA in place, managing the principal’s affairs, such as paying bills, making financial decisions, or handling legal matters, could become extremely challenging or even impossible. A well-drafted and executed POA ensures that someone trusted by the principal can step in and manage their affairs effectively when they are unable to do so themselves.

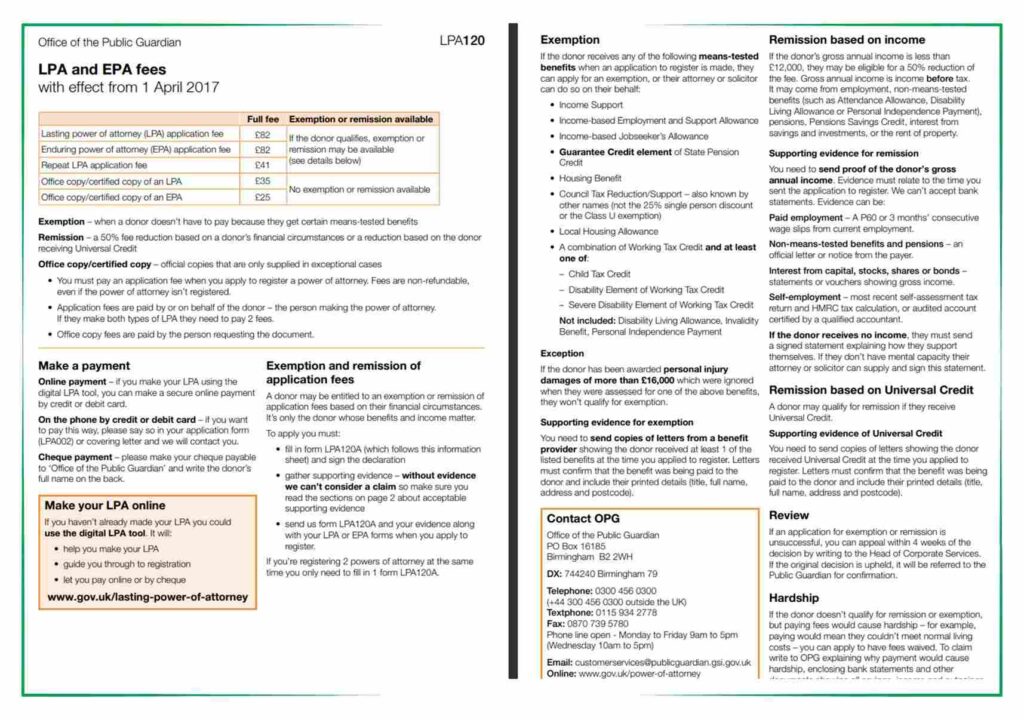

The type of POA plays a significant role in determining the cost. For example, a simple General Power of Attorney might be less expensive than a Lasting Power of Attorney (LPA), which provides broader authority and involves more complex legal considerations.

Geographic location also impacts the cost, with fees varying between different jurisdictions and countries. Legal professionals’ fees, including initial consultation, drafting, reviewing the POA document, notarization, and certification, contribute to the overall cost.

Power of Attorney Cost UK

How Much Does It Cost For Power of Attorney?

Everlasting Power of Attorney Cost

Age Concern Power of Attorney Cost

How Much Does a Lasting Power of Attorney Cost?

Cost of Certified Copies of Power of Attorney UK

Cost of Power of Attorney Through a Solicitor

Hello, I’m Inna Evdokimova, an IP Lawyer and Patent Attorney based in the United Kingdom. With a passion for intellectual property law, I specialize in providing expert guidance and legal representation to clients navigating the complexities of patent law in the UK.

With years of experience in the field, I’ve cultivated a deep understanding of the intricacies of intellectual property rights, empowering individuals and businesses alike to protect their innovations and creations effectively.

Through my website, powerofattorneyuk.uk, I aim to serve as a valuable resource for those seeking clarity and assistance in matters of patent law and intellectual property rights. Whether you’re looking to secure a patent for your invention or require guidance on IP-related legal issues, my mission is to provide you with personalized, reliable solutions tailored to your unique needs.

I’m dedicated to helping my clients safeguard their intellectual property assets and navigate the legal landscape with confidence. With a commitment to excellence and client satisfaction, I strive to deliver results-driven strategies and advocacy that exceed expectations.

I look forward to the opportunity to assist you on your intellectual property journey and help you unlock the full potential of your innovations.