Martin Lewis, a prominent figure in the realm of personal finance and consumer advocacy, sheds light on the crucial importance of the Martin Lewis Power of Attorney (POA) as an essential component of estate planning. Martin Lewis is a renowned financial journalist, television presenter, and consumer champion. He is widely recognized for his expertise in personal finance and for providing valuable advice to individuals on managing their money effectively. With a background in journalism and finance, Martin Lewis has become a trusted authority on various financial topics, including the importance of estate planning tools such as the Power of Attorney (POA).

A Power of Attorney (POA) is a paper that lets someone choose another person or group, called the attorney-in-fact or agent, to make choices and do things for them. These can be about money, health, property, or legal stuff. Martin Lewis says making a POA is really important for planning your estate well. It helps keep your interests safe and handled right if you can’t make decisions on your own because of sickness or other reasons.

Having a Power of Attorney (POA) is super important for a couple of big reasons, and Martin Lewis explains why it’s so crucial. First, with a POA, you can choose someone you trust to handle your affairs if something happens to you and you can’t make decisions because of illness, injury, or other issues. This ensures that important financial and healthcare choices are still made according to your wishes.

Secondly, a POA prevents potential legal and financial problems that could arise if you don’t have this document. Without a POA, your family or loved ones might struggle to access your finances, pay bills, or make medical decisions for you if you’re unable to do so yourself.

Table of Contents

ToggleMartin Lewis Power of Attorney

While Martin Lewis, the well-known UK personal finance expert, doesn’t create his own Power of Attorney (POA) forms, he strongly encourages people to understand and make Lasting Power of Attorney (LPA) documents in England and Wales. Here’s how Martin Lewis talks about POAs:

Martin Lewis on the Importance of Power of Attorney:

- More Crucial Than a Will: Lewis stresses that a POA is vital because it works while you’re alive but unable to handle your affairs, unlike a will that deals with your assets after you pass away.

- Avoids Troublesome Situations: Without a POA, if you become unable to make decisions due to sickness, injury, or old age, your family might need to go through a hard and costly court process to manage your money and care.

What Martin Lewis Recommends About POAs:

- Not Just for Older Adults: Anyone can benefit from having a POA, no matter their age. Unexpected accidents or illnesses can happen to anyone.

- Pick Your Agent Carefully: Choose someone you trust completely and who knows your financial situation and goals well.

Where to Get Information (Not Lewis’ Forms):

Martin Lewis probably wouldn’t provide POA forms directly. There are legal complexities involved, and it’s important to make sure the forms follow current rules. Here are some places Lewis might suggest:

- Government Help: England & Wales: https://www.gov.uk/power-of-attorney has LPA forms you can download and advice.

- Legal Professionals: A lawyer who specializes in POAs can give you personalized help and make sure the LPA meets your needs.

Overall Impact:

Martin Lewis’ support has likely made more people aware of how important POAs are in the UK. By talking about the risks and benefits of having a POA, he has motivated many to plan ahead and make sure their wishes are honored, even if they can’t make decisions themselves.

Power of Attorney Cost Martin Lewis

Martin Lewis, a renowned expert in UK personal finance, strongly advocates for individuals to have a Lasting Power of Attorney (LPA) in effect. Although he doesn’t directly supply LPA forms, he underscores the significance of understanding the expenses involved in setting one up.

Here’s what Martin Lewis stresses regarding Power of Attorney costs:

Government Charges: The primary cost varies by region:

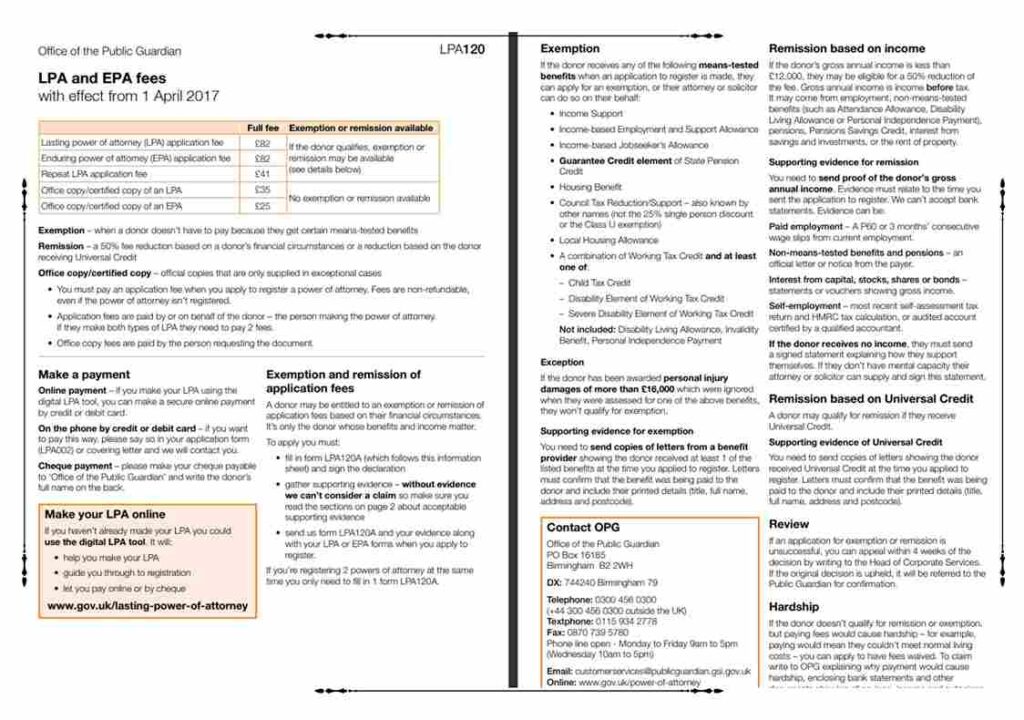

- England & Wales: The fee for applying for an LPA through the government website (https://www.gov.uk/power-of-attorney) is typically £82.

- Scotland: Costs slightly more than in England and Wales, with a fee of around £151 for a Continuing Power of Attorney (PoA).

- Northern Ireland: The most costly option, with a Continuing PoA application costing approximately £151.

DIY vs. Solicitor: If your situation is straightforward and you’re comfortable with the process, you can apply for an LPA yourself. However, Martin Lewis likely suggests consulting an LPA-specializing solicitor for more complex scenarios, incurring additional solicitor fees.

Additional Expenses to Note:

- Certificate Provider (England & Wales): You might need a doctor or solicitor (a “certificate provider”) in England and Wales to confirm your mental capacity to comprehend the LPA. Their fee varies based on the professional.

- Registration Fees (England & Wales Only): After completing the LPA application, there’s a registration fee with the Office of the Public Guardian (OPG) in England and Wales, typically around £82. Scotland doesn’t require registration.

Martin Lewis’ Central Message:

Although there are upfront costs associated with creating a Power of Attorney, Martin Lewis likely emphasizes that these are minor compared to the potential difficulties if you don’t have one. Without a POA, if you become incapacitated, your loved ones might encounter a lengthy and costly legal process to manage your affairs.

Important Reminder:

The information provided gives a general overview. It’s advisable to consult the latest government resources for precise fee details in your specific jurisdiction (England, Wales, Scotland, or Northern Ireland). Here are some helpful resources:

- England & Wales: https://www.gov.uk/power-of-attorney

- Scotland: https://www.mygov.scot/power-of-attorney

Martin Lewis Wills and Power of Attorney

Martin Lewis, a prominent advocate for personal finance in the UK, strongly champions two vital legal documents: Wills and Lasting Power of Attorney (LPAs). Although he doesn’t provide these documents directly, he underscores their critical role in securing your future and safeguarding your family’s well-being.

Martin Lewis on Wills:

- Provides Peace of Mind: A will ensures that your wishes regarding your assets are honored after you pass away, reducing confusion and potential conflicts among family members.

- Enables Control Over Distribution: Without a will, laws determine how your assets are distributed, which may not align with your intentions.

Martin Lewis on Power of Attorney:

- Sometimes More Essential Than a Will: Lewis argues that a POA can be even more crucial than a will because it helps if you become mentally incapable during your lifetime, unlike a will which comes into effect after death.

- Prevents Difficult Situations: Without a POA, your loved ones might struggle to manage your finances and care if you become unable to make decisions. This can lead to a lengthy and expensive legal process.

Key Points Martin Lewis Might Highlight:

- DIY vs. Solicitor: While you can create these documents yourself, Martin Lewis may suggest consulting a solicitor for complex situations or significant estates.

- Costs Involved: Both wills and LPAs have associated fees, including government application fees, potential solicitor fees, and registration costs (for LPAs in England and Wales).

- Importance of Planning Ahead: Despite upfront costs, Martin Lewis likely stresses that the peace of mind and potential savings in the long run outweigh these expenses.

Overall Impact:

Martin Lewis’s advocacy for wills and LPAs has empowered many individuals to plan for their future effectively. These documents ensure that your wishes are known and respected, reducing stress and financial burdens for your loved ones during challenging times.

Additional Resources:

Government Resources:

- Wills: Information on creating a will can be found on general government websites.

- LPAs:

- England & Wales: https://www.gov.uk/power-of-attorney

- Scotland: https://www.mygov.scot/power-of-attorney

Martin Lewis Lasting Power of Attorney

Martin Lewis, a notable expert in UK personal finance matters, strongly supports the use of Lasting Power of Attorney (LPA) in England and Wales. While he doesn’t supply LPA forms directly, he stresses its significance as a tool to ensure your preferences are upheld if you’re unable to make decisions on your own.

Martin Lewis’s Insights on Why LPAs Are Vital:

- More Immediate than a Will: While a will deals with asset distribution after death, an LPA becomes effective if you’re alive but incapacitated due to illness, injury, or age. Martin Lewis highlights this distinction, noting that an LPA can be even more crucial for immediate well-being.

- Avoids Complex Legal Battles: Without an LPA, your loved ones might face a costly and protracted legal battle to manage your affairs if you’re unable to. An LPA sidesteps this by appointing a trusted individual to act on your behalf.

Key Points Martin Lewis Might Stress:

- Not Limited to Seniors: Unexpected events can happen at any age. Martin Lewis likely encourages everyone to consider having an LPA, regardless of their age.

- Choose Wisely: Select an attorney-in-fact you trust completely and who understands your financial situation and goals. Clearly communicate your expectations to them.

- DIY vs. Professional Help: While you can apply for an LPA yourself online, Martin Lewis may recommend consulting a solicitor for complex situations or substantial estates.

Potential Costs Involved:

- Government Fees: The application fee for an LPA through the government website is typically £82 in England and Wales.

- Certificate Provider (Optional): In England and Wales, you may need a professional (like a doctor or solicitor) to verify your mental capacity, with their fee varying.

- Registration Fees (England & Wales Only): Once completed, LPAs require registration with the Office of the Public Guardian, costing around £82. Scotland doesn’t require this step.

Martin Lewis’ Likely Message:

Despite initial costs, Martin Lewis would likely argue that the benefits of having an LPA far outweigh these expenses. It provides reassurance knowing your wishes will be respected, even in challenging circumstances.

Additional Resources:

Martin Lewis wouldn’t provide direct legal advice, but he might recommend the following resources for further information:

- Government Resources:

- England & Wales: https://www.gov.uk/power-of-attorney for downloadable LPA forms and guidance.

- Solicitors: Consulting a legal professional specializing in LPAs can offer tailored advice and ensure your LPA meets your specific needs.

By stressing the importance of LPAs, Martin Lewis empowers individuals to plan ahead and protect themselves and their families effectively during uncertain times.

Martin Lewis Power of Attorney Refund

Martin Lewis, renowned as the UK’s money-saving expert, is no longer directly involved with Power of Attorney (POA) refunds. However, he may have previously highlighted a particular refund scheme. Here’s what happened:

Past Refund Scheme:

- From 2013 to 2017, the fees for registering Lasting Power of Attorney (LPA) in England and Wales were higher than they are now.

- In 2017, these fees were reduced.

- During that period, the Office of the Public Guardian (OPG) introduced a one-time refund scheme for those who had paid the higher fees between 2013 and 2017.

Martin Lewis’ Potential Involvement:

- Martin Lewis, known for championing consumer rights, could have promoted this refund scheme to ensure people were aware of the opportunity to reclaim some of their LPA registration costs.

Current Situation (No Ongoing Refunds):

- The refund scheme was a one-time offer and concluded around 2020. There are currently no ongoing initiatives for refunds related to LPA registration fees.

Martin Lewis’ Likely Message:

- Although Martin Lewis isn’t currently involved with refunds, he would likely advise people to check government websites for the latest information on LPA registration fees and any potential future changes.

Resources:

- While there are no active refunds, here are some useful resources for information about LPAs:

- England & Wales: https://www.gov.uk/power-of-attorney provides details about LPA fees and the registration process.

- Scotland: https://www.mygov.scot/power-of-attorney offers information about Continuing Power of Attorney (PoA) in Scotland.

Overall:

- While a specific refund scheme existed in the past, it is no longer available. Martin Lewis likely focused on informing people about the opportunity when it was active. Presently, the emphasis is on understanding current LPA fees and the registration process.

Martin Lewis Power of Attorney Fees

Martin Lewis, the well-known money-saving expert in the UK, strongly encourages individuals to have Lasting Power of Attorney (LPA) documents in place. While he doesn’t directly sell or create LPA forms, he stresses the importance of understanding the costs involved. Here’s what Martin Lewis likely highlights about Power of Attorney fees:

Government Fees:

- In England & Wales, applying for an LPA through the government website (https://www.gov.uk/power-of-attorney) typically costs £82.

- In Scotland, the fee is slightly higher, around £151 for a Continuing Power of Attorney (PoA).

- Northern Ireland has the highest fee, with a Continuing PoA application costing roughly £151.

DIY vs. Solicitor:

- Martin Lewis would likely encourage applying yourself if your situation is straightforward and you feel comfortable doing so. The government website provides guidance and downloadable forms.

- For complex situations or significant estates, Martin Lewis might recommend consulting a solicitor specializing in LPAs. Their fees would be in addition to the government application charge.

Additional Costs (England & Wales):

- Certificate Provider: You may need a doctor or solicitor (a “certificate provider”) to verify your mental capacity. Their fee varies.

- Registration Fee: Once completed, LPAs require registration with the Office of the Public Guardian (OPG), with a fee of around £82. Scotland does not require registration.

Martin Lewis’ Key Message:

- While there are upfront costs associated with creating a Power of Attorney, Martin Lewis would likely argue that these are minimal compared to the potential problems if you don’t have one in place. Without an LPA, if you become incapacitated, your loved ones might face a lengthy and expensive legal process to manage your affairs.

The Takeaway:

- By understanding Power of Attorney fees and the benefits, you can make an informed decision. Martin Lewis likely emphasizes that planning ahead with an LPA can save you and your loved ones money and stress in the long run.

FAQ

Why does Martin Lewis say a Power of Attorney is important?

Martin Lewis highlights two key reasons why having a Power of Attorney (POA) is crucial:

- Empowers Decision-Making During Incapacity: Unlike a will, which handles asset distribution after death, a Lasting Power of Attorney (LPA) becomes effective while you’re alive but unable to make decisions due to illness, injury, or age. Martin Lewis stresses this difference because an LPA ensures your wishes are honored even when you’re unable to express them directly.

- Protects Loved Ones from Legal Hassles: Without an LPA, if you experience incapacitation, your loved ones may encounter a challenging and costly situation. They might need to navigate a prolonged court process to manage your finances and care. An LPA sidesteps these difficulties by appointing a trusted individual to act on your behalf beforehand.

In summary:

- Will: Focuses on asset distribution post-mortem.

- LPA: Manages affairs and finances during incapacity. Martin Lewis likely argues that an LPA can be more critical than a will in certain scenarios, as it safeguards your well-being throughout your lifetime.

Does Martin Lewis offer Power of Attorney forms?

No, Martin Lewis does not directly provide Power of Attorney (POA) forms.

Here are the reasons why:

- Legal Complexity: Lasting Power of Attorney (LPA) forms, especially specific to England and Wales, involve legal intricacies. Ensuring that these forms comply with current regulations and accurately represent your intentions is crucial. Martin Lewis would likely avoid potential legal issues that may arise from providing downloadable forms.

- Focus on Awareness: Martin Lewis’s primary objective is to increase awareness about the importance of LPAs. He encourages individuals to comprehend the advantages and the process of establishing a Power of Attorney. However, the actual creation process may require resources beyond what he can directly offer.

However, Martin Lewis would likely guide people to the appropriate resources for LPA forms:

- Government Resources:

- England & Wales: https://www.gov.uk/power-of-attorney provides downloadable LPA forms and guidance.

- Solicitors: Seeking assistance from a solicitor who specializes in LPAs can offer personalized advice and ensure that the LPA aligns with your specific requirements.

Why does Martin Lewis talk about Power of Attorney costs?

Martin Lewis discusses Power of Attorney (POA) costs in the UK for two main reasons:

- Transparency and Informed Decision-Making:

- Martin Lewis advocates for financial literacy and encourages people to make informed choices about their finances. Discussing POA costs aligns with this philosophy.

- By comprehending the initial costs associated with establishing a Power of Attorney, individuals can assess them against potential benefits and determine if it’s the right choice for their circumstances.

- Long-Term Savings Perspective:

- Martin Lewis emphasizes that while there are upfront costs linked with creating a POA, these are often much lower than the potential challenges and expenses that may arise without one.

- Without a POA, individuals risk facing a costly and time-consuming court process for managing their finances and care during incapacitation, leading to emotional and financial strain for loved ones.

Breakdown of the Logic:

- POA Costs: Include upfront fees for application, potential solicitor fees, and registration costs (if applicable).

- Without POA: Potential expenses from a court process, delays in managing finances and care, and emotional stress and conflict for loved ones.

- Martin Lewis contends that by understanding both aspects (costs vs. potential issues), individuals can make a well-informed decision about creating a POA. Ultimately, having a POA can result in long-term savings and reduced stress for individuals and their loved ones.

Why does Martin Lewis talk about Wills and Power of Attorney?

Martin Lewis discusses Wills and Lasting Power of Attorney (LPAs) in the UK for several significant reasons:

- Financial Preparedness: Martin Lewis strongly advocates for being financially prepared for the future. Having a Will and LPA ensures that your wishes are clearly stated and carried out, reducing stress and potential issues for both you and your loved ones.

- Peace of Mind: Both documents provide a sense of peace and security. A Will ensures that your assets are distributed according to your wishes after your passing, while an LPA ensures that your care and finances are managed as you desire if you become unable to make decisions.

- Cost Considerations: Despite the initial costs associated with Wills and LPAs, Martin Lewis likely highlights that these expenses are often significantly lower than the potential costs that may arise without these documents.

- Without a Will: The law dictates asset distribution, potentially leading to conflicts and legal expenses.

- Without an LPA: Your loved ones may encounter a costly and time-consuming legal process to handle your affairs in case of incapacity. Martin Lewis underscores the following benefits:

- Wills: Control over asset distribution post-mortem, reducing confusion and potential disputes.

- LPAs: Avoids challenges for loved ones during your incapacitation, potentially saving them time and money on legal procedures.

By raising awareness about Wills and LPAs, Martin Lewis encourages individuals to proactively plan for their future and safeguard themselves and their loved ones during difficult times. He emphasizes the long-term advantages these documents offer, including emotional well-being and potential cost savings.

Hello, I’m Inna Evdokimova, an IP Lawyer and Patent Attorney based in the United Kingdom. With a passion for intellectual property law, I specialize in providing expert guidance and legal representation to clients navigating the complexities of patent law in the UK.

With years of experience in the field, I’ve cultivated a deep understanding of the intricacies of intellectual property rights, empowering individuals and businesses alike to protect their innovations and creations effectively.

Through my website, powerofattorneyuk.uk, I aim to serve as a valuable resource for those seeking clarity and assistance in matters of patent law and intellectual property rights. Whether you’re looking to secure a patent for your invention or require guidance on IP-related legal issues, my mission is to provide you with personalized, reliable solutions tailored to your unique needs.

I’m dedicated to helping my clients safeguard their intellectual property assets and navigate the legal landscape with confidence. With a commitment to excellence and client satisfaction, I strive to deliver results-driven strategies and advocacy that exceed expectations.

I look forward to the opportunity to assist you on your intellectual property journey and help you unlock the full potential of your innovations.