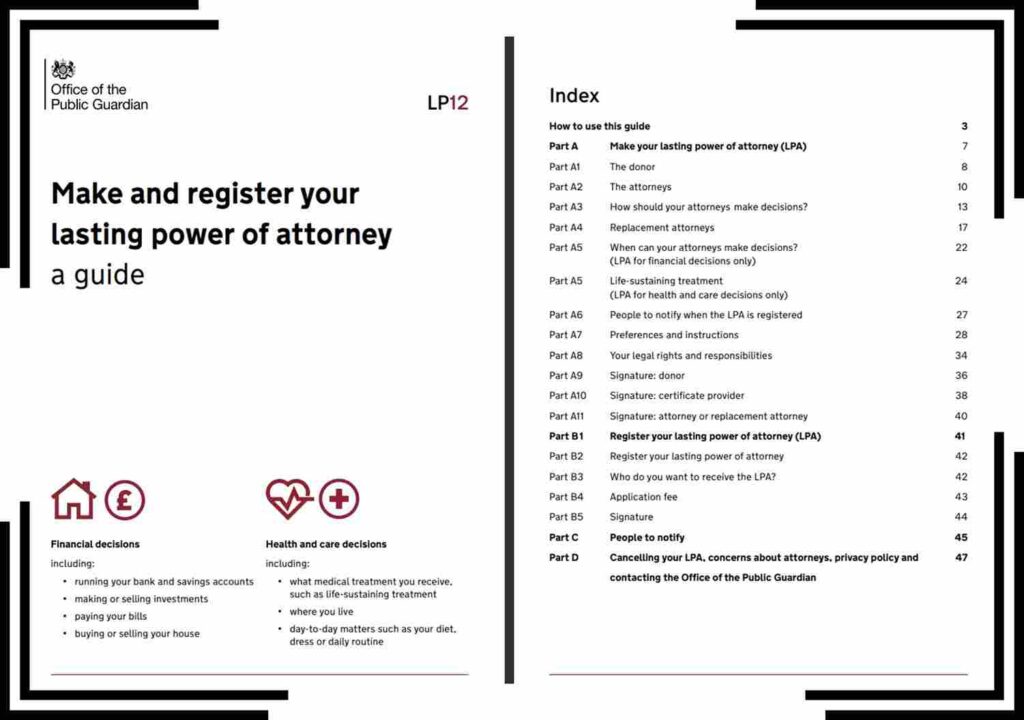

In this Lasting Power of Attorney Guide, we delve into the essential aspects of LPAs, which are powerful legal documents in the UK. An LPA is a legal tool that allows an individual, referred to as the donor, to appoint someone they trust as their attorney. The purpose of an LPA is to grant the attorney the authority to make important decisions on behalf of the donor if the donor becomes unable to make those decisions themselves due to mental incapacity.

LPAs hold immense significance in the UK legal framework as they provide a structured and legally recognized method for individuals to plan for their future decision-making needs. By creating an LPA, individuals can ensure that their affairs are managed according to their wishes, even if they are no longer capable of expressing those wishes directly. This legal instrument offers peace of mind and ensures that the donor’s best interests are protected and respected.

In Lasting Power of Attorney Guide For donors, the benefits of having an LPA are substantial. They can choose a trusted individual to act as their attorney, thus ensuring that their financial, property, health, and welfare matters are handled competently and in line with their preferences. Donors can also specify the scope of authority granted to their attorneys, providing flexibility and control over their affairs.

Attorneys, on the other hand, play a crucial role in ensuring the well-being and interests of the donors. They are entrusted with making decisions that align with the donor’s wishes, promoting their autonomy and ensuring that their affairs are managed responsibly. Additionally, attorneys have the legal backing to carry out their duties effectively, providing a structured framework for decision-making in challenging circumstances.

Lasting Power of Attorney or LPA Guide

Lasting Power of Attorney or LPA Guide

Lasting Power of Attorney Guide PDF

Lasting Power of Attorney Guide PDF

Types of Lasting Power of Attorney

Creating a Lasting Power of Attorney

FAQ

What is a Lasting Power of Attorney (LPA)?

Hello, I’m Inna Evdokimova, an IP Lawyer and Patent Attorney based in the United Kingdom. With a passion for intellectual property law, I specialize in providing expert guidance and legal representation to clients navigating the complexities of patent law in the UK.

With years of experience in the field, I’ve cultivated a deep understanding of the intricacies of intellectual property rights, empowering individuals and businesses alike to protect their innovations and creations effectively.

Through my website, powerofattorneyuk.uk, I aim to serve as a valuable resource for those seeking clarity and assistance in matters of patent law and intellectual property rights. Whether you’re looking to secure a patent for your invention or require guidance on IP-related legal issues, my mission is to provide you with personalized, reliable solutions tailored to your unique needs.

I’m dedicated to helping my clients safeguard their intellectual property assets and navigate the legal landscape with confidence. With a commitment to excellence and client satisfaction, I strive to deliver results-driven strategies and advocacy that exceed expectations.

I look forward to the opportunity to assist you on your intellectual property journey and help you unlock the full potential of your innovations.