A Lasting Power of Attorney (LPA) is a special paper that lets someone choose a trusted person (called an attorney) to make choices for them if they can’t decide for themselves in the future. This helps give peace of mind and makes sure that the person’s stuff is taken care of and decisions are made in their best interest, even if they can’t say what they want at that time.

Making an LPA is really important for a few reasons. First, it lets people pick who they trust to decide things for them, instead of having strangers or officials decide if they can’t make choices. This makes sure that the person’s wishes are respected and followed. Second, an LPA can avoid problems and delays in managing their stuff because it gives clear permission to the chosen attorneys to take care of things like money, healthcare choices, and other important stuff in their life.

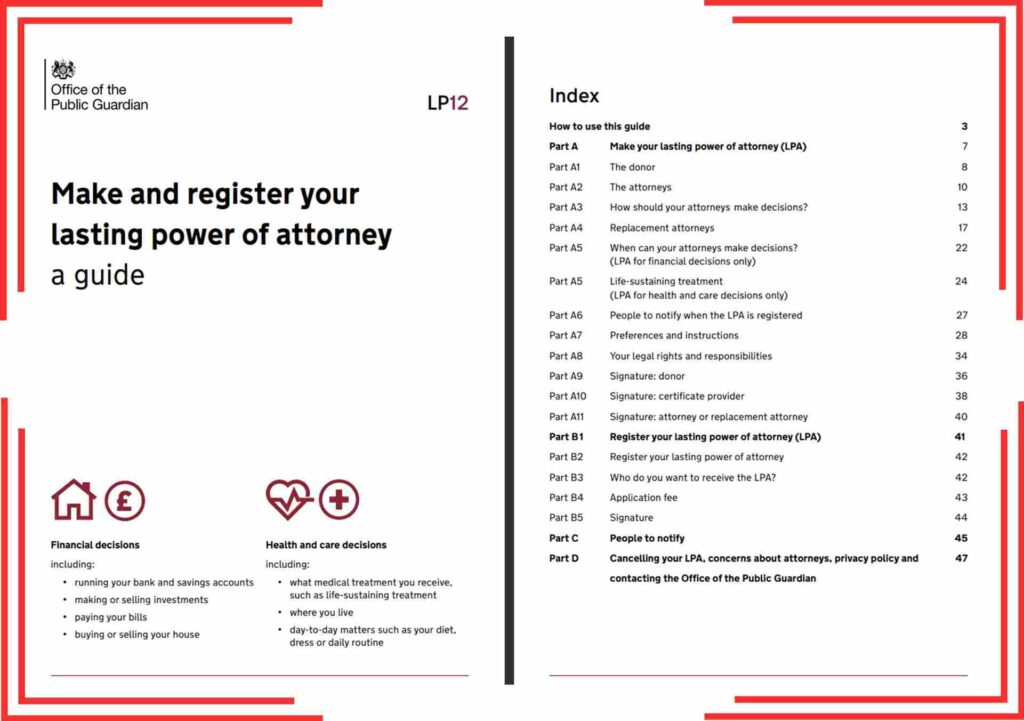

There are two main types of LPAs: one for money and stuff (called property and financial affairs LPA) and another for health and personal things (called health and welfare LPA). The money one lets attorneys handle finances, pay bills, and sell stuff if needed. The health one lets attorneys decide about medical care, where to live, and other personal things. Having both types of LPAs is good because it covers everything and helps make decisions easier if the person can’t decide for themselves.

Table of Contents

ToggleLasting Power Of Attorney UK

A Lasting Power of Attorney (LPA) is a legal document used in the UK that lets you appoint someone you trust (called an attorney) to make decisions for you if you can’t do so yourself. This is especially important if you become unable to make choices due to illness, injury, or age.

There are two main types of LPAs:

- LPA for health and welfare: This allows your attorney to decide about your medical care, where you live, and your end-of-life wishes.

- LPA for property and financial affairs: This lets your attorney manage your money, pay bills, and handle your property based on your instructions.

The benefits of having an LPA include:

- Peace of Mind: Knowing your trusted person can handle things for you if needed brings peace of mind for you and your family.

- Avoiding Court: An LPA prevents the need for a costly and lengthy court process to appoint a decision-maker on your behalf.

- Control and Choice: You get to pick someone you trust to be your attorney, ensuring your wishes are followed.

To create an LPA:

- Eligibility: You must be 18 or older and mentally capable (able to understand the document and its implications) to make an LPA.

- The Process: There are official forms to fill out for an LPA. You can do it yourself or with a solicitor’s help. The LPA must be witnessed and registered with the Office of the Public Guardian (OPG) to be valid.

- Key Decisions: You can specify how much authority your attorney has and include any specific instructions you want them to follow.

Important things to consider:

- Choosing Attorneys: Pick someone responsible and trustworthy who understands your wishes.

- Keeping it Updated: You can review and change your LPA while you’re mentally capable.

- Getting Legal Advice: Consulting a solicitor can ensure your LPA is done correctly and reflects what you want.

A Lasting Power of Attorney is a valuable tool for planning ahead, ensuring your affairs are taken care of by someone you trust. Understanding the types of LPAs and the process helps you make informed decisions for your future.

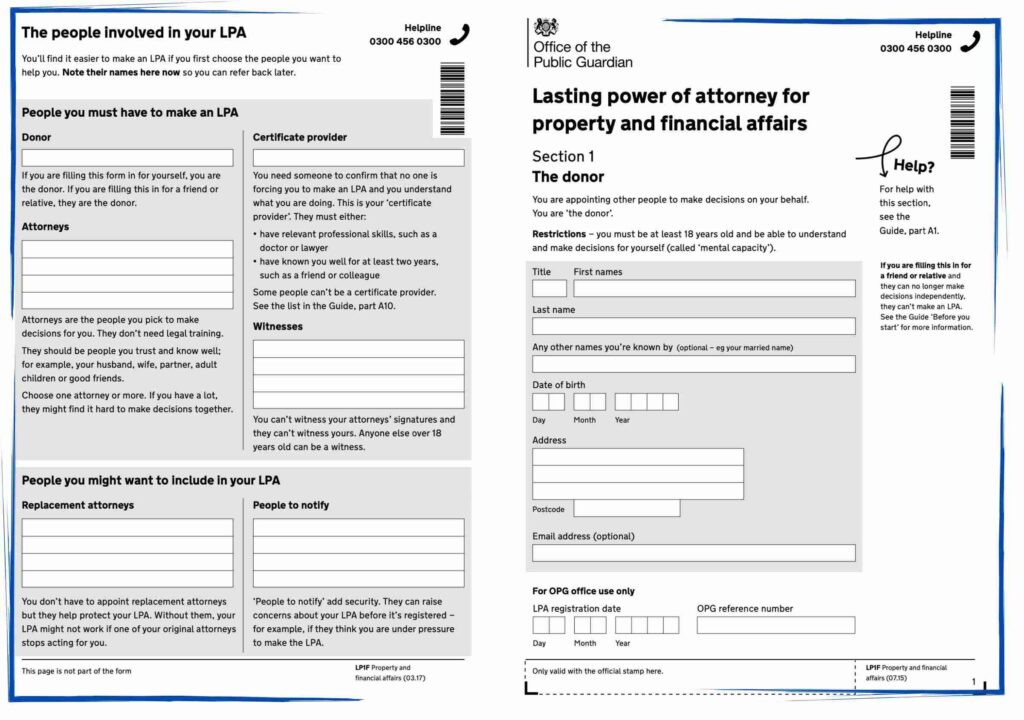

Lasting Power of Attorney Forms

Lasting Power of Attorney For Property And Financial Affairs

Lasting Power of Attorney For Property And Financial Affairs

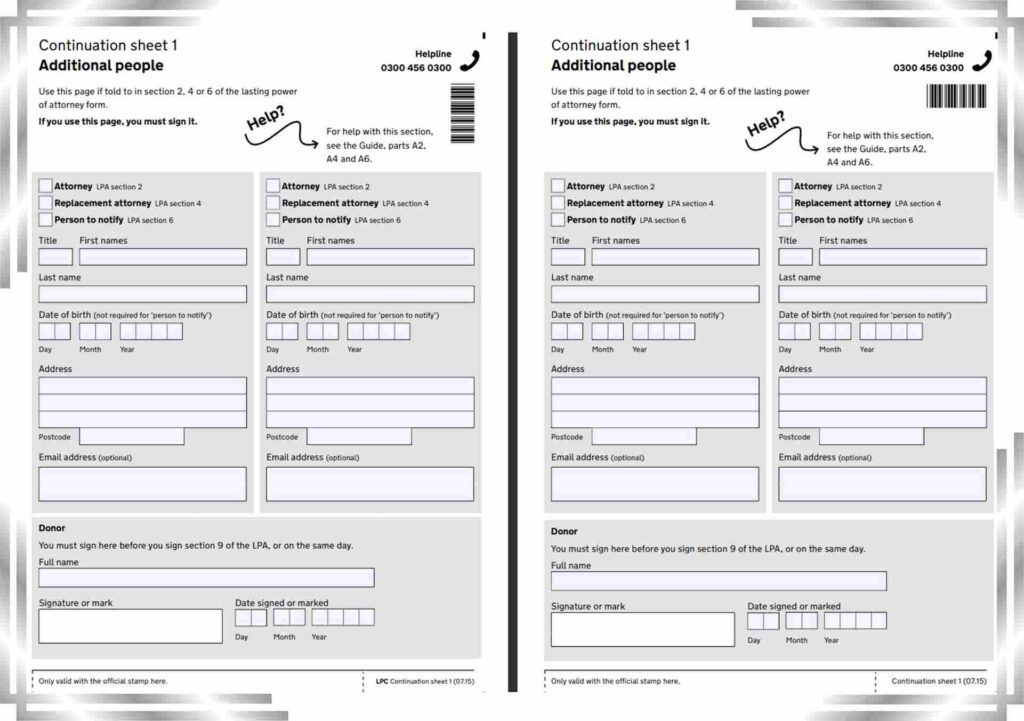

Lasting Power of Attorney Form To Notifying Peoples

Lasting Power of Attorney Form To Notifying Peoples

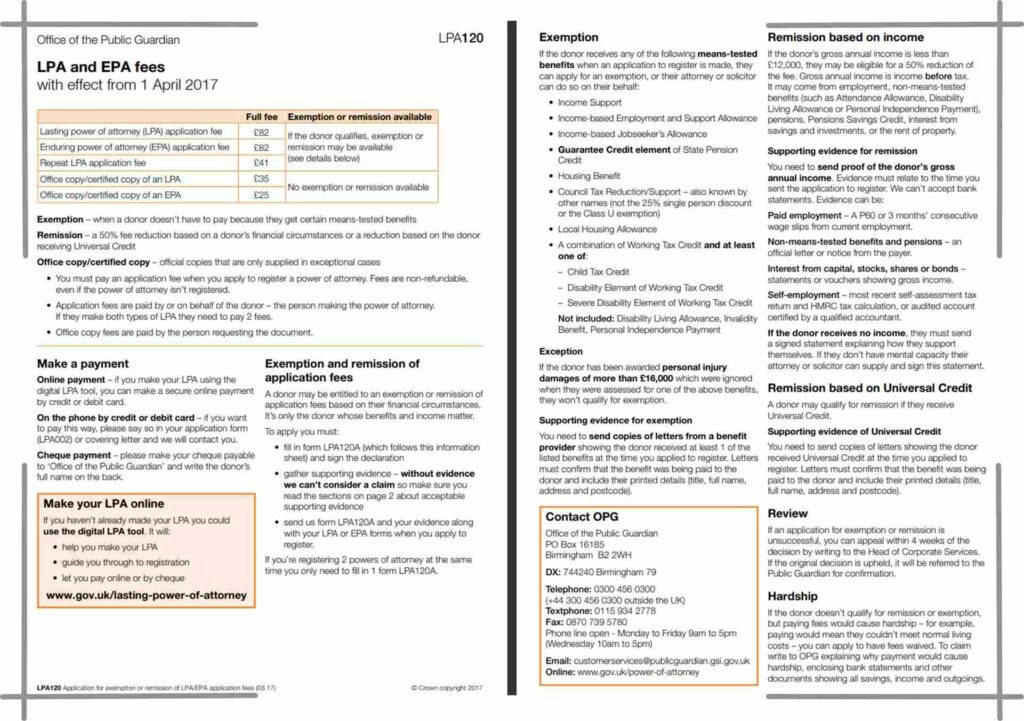

Lasting Power Of Attorney and EPA Fees

Lasting Power Of Attorney Continuation Sheets

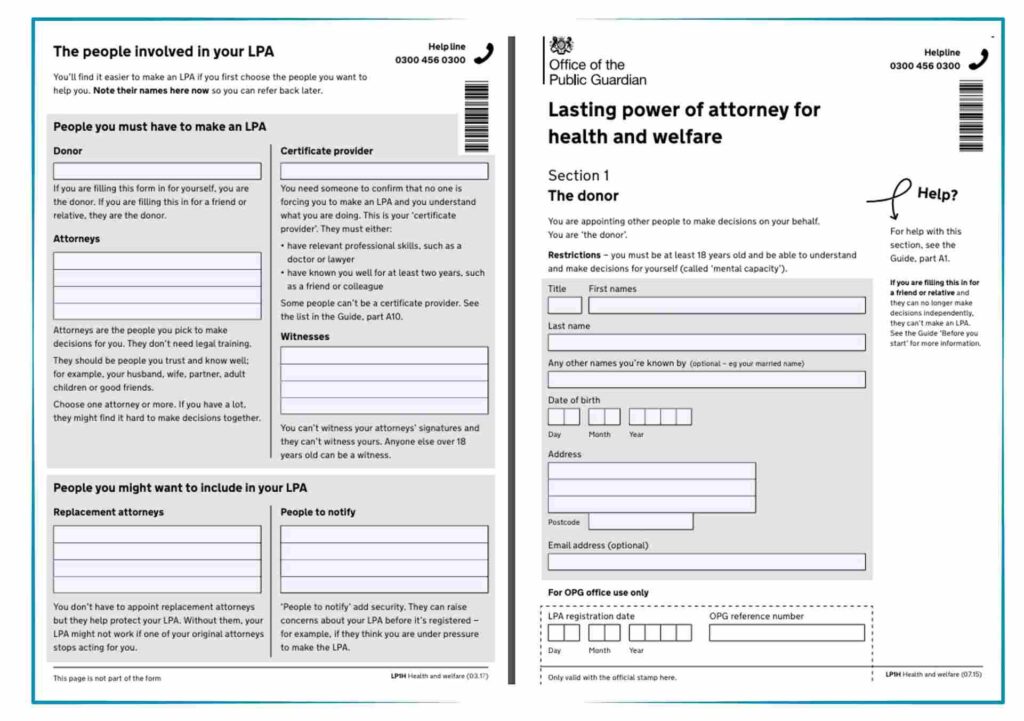

Lasting Power of Attorney For Health and Welfare

Lasting Power of Attorney For Health and Welfare

Lasting Power of Attorney Login

I see you’re interested in accessing a Lasting Power of Attorney (LPA) login, but there are a few key points to clarify:

- No Direct Online Login: Currently, the UK government doesn’t provide a direct online login system specifically for creating or managing LPAs. Instead, they offer an online service to guide you through the LPA creation process on their official website.

- Process Requires Physical Documents: Creating an LPA involves downloadable forms that require signatures from various individuals and registration with a government office. These steps cannot be completed entirely online; physical documents are necessary.

Here’s how you can make use of the government’s online LPA service:

- Access the Service: Visit the official UK government website dedicated to Lasting Power of Attorney: https://www.gov.uk/power-of-attorney

- Choose Your Method: The website offers options for online guidance or downloadable paper forms, depending on your preference.

- Use the Online Tool (Optional): If you opt for the online tool, it can assist you in understanding the process, completing the forms electronically, and saving your progress.

- Print and Sign: Regardless of using the online tool, you must print the completed forms and gather wet ink signatures from all relevant parties, including attorneys, witnesses, and the certificate provider.

- Registration is Crucial: Submit the signed documents to the Office of the Public Guardian (OPG) for registration. This step activates the LPA, typically taking around 20 weeks.

Alternatively:

- Paper Forms: You have the option to directly download and print the LPA forms, bypassing the online tool if you prefer.

Important Points to Remember:

- Seek Legal Advice: Consulting a solicitor can ensure that your LPA is tailored to your specific needs and complies with legal regulations.

- Regular Review: It’s essential to review and update your LPA periodically, as needed, while you are mentally capable.

Although there isn’t a direct LPA login system, the government website provides valuable resources to assist you through the process. Think of it as an informative guide rather than a one-step login solution.

Lasting Power of Attorney Online

While the term “Lasting Power of Attorney (LPA) Online” may imply a straightforward login and creation procedure, the UK government’s system is a bit more detailed. Here’s a breakdown of what you can expect from the online service and the steps involved in making an LPA:

What the Online Service Does:

- Provides Guidance and Support: The government’s website offers an easy-to-use online tool to assist you in creating an LPA. This includes step-by-step instructions, helpful explanations, and the option to save your progress as you work through the process.

- Facilitates Form Completion: Within the online tool, you can electronically fill out the LPA forms, making editing and review more convenient compared to traditional paper forms.

What the Online Service Doesn’t Do:

- Doesn’t Finalize the LPA: It’s important to note that the online tool doesn’t finalize the LPA on its own. You’ll need to print the completed forms and obtain physical signatures for them to be legally valid.

- Doesn’t Accept E-Signatures or Digital Copies: The current requirement is for wet ink signatures on the original documents. Electronic signatures or copies are not accepted.

Steps to Creating an LPA Online:

- Access the Service: Begin by visiting the official UK government website dedicated to Lasting Power of Attorney: https://www.gov.uk/power-of-attorney

- Start the Online Process: Select the option to “make an LPA” and follow the instructions provided.

- Complete the Forms Electronically: Use the online tool to fill out the LPA forms. You can save your progress and return later to finish them.

- Printing and Signatures: Once you’ve completed the forms online, print them out. Remember that all parties involved, including attorneys, witnesses, and the certificate provider, must sign the original paper documents with wet ink.

- Registration: After obtaining all necessary signatures, submit the completed LPA to the Office of the Public Guardian (OPG) for registration. This activation process typically takes about 20 weeks.

Additional Points to Consider:

- Paper Forms Alternative: If preferred, you can download paper forms directly from the website and complete them without using the online tool.

- Professional Guidance: Consulting with a solicitor can ensure that your LPA is tailored to your specific needs and complies with legal requirements.

- Review and Update: It’s important to regularly review and update your LPA as needed, while you still have mental capacity.

The online service provided by the UK government is a valuable resource for creating a Lasting Power of Attorney. It offers guidance, simplifies form completion, and allows for progress saving. However, keep in mind that the online tool is just one aspect of the process, and physical documents, signatures, and registration are crucial steps in creating a valid LPA.

Using a Lasting Power of Attorney

A Lasting Power of Attorney (LPA) is a legal document in the UK that allows you to choose a trusted person (called an attorney) to make decisions on your behalf, especially if you’re unable to do so due to illness, injury, or age. There are two main types of LPAs:

- LPA for health and welfare: This lets your attorney decide about your medical care, daily life arrangements, and end-of-life wishes.

- LPA for property and financial affairs: This gives your attorney the power to handle your money, bills, and property based on your instructions.

How Using an LPA Works:

- Registration: Your LPA only becomes active after it’s registered with the Office of the Public Guardian (OPG).

- Following Your Wishes: Your attorney must act in your best interests and follow the instructions you’ve given in the LPA.

- Communication: It’s good for your attorney to keep you updated, especially about important decisions.

Benefits of Using an LPA:

- Peace of Mind: Knowing your affairs are in trusted hands brings peace of mind for you and your family.

- Avoids Court Processes: An LPA skips the need for a long and expensive court process to appoint someone to make decisions for you.

- Choice and Control: You choose who you trust as your attorney, ensuring your wishes are honored.

Responsibilities of the Attorney:

- Careful Management: Your attorney must handle your affairs with care and responsibility.

- Communication: They should keep you informed, especially about money matters.

- No Conflicts: Your attorney should avoid situations where their interests clash with yours.

- Loyalty: They must act in your best interests and not benefit personally from your assets.

Important Considerations:

- Choosing Attorneys: Pick someone trustworthy who understands your wishes.

- Updates: You can change your LPA while you’re mentally capable.

- Legal Help: Consulting a solicitor ensures your LPA is done right and appoints the right attorneys.

Using an LPA is a responsible way to plan ahead. Understanding its workings, benefits, and responsibilities helps you make informed decisions for your peace of mind and your loved ones’ well-being.

Lasting Power of Attorney Gov UK

The Gov.UK website is a valuable source of information about Lasting Power of Attorney (LPA) in the UK. Below is a breakdown of the essential details you’ll find there:

Understanding Lasting Power of Attorney (LPA):

An LPA is a legal paper that lets you appoint a trusted person (an attorney) to make decisions for you if you can’t due to mental incapacity. There are two main types:

- LPA for health and welfare: Covers medical decisions, daily life choices, and end-of-life wishes.

- LPA for property and financial affairs: Enables your attorney to manage your money, property, and bills.

Benefits of Having an LPA:

Creating an LPA comes with various advantages:

- Peace of mind: Knowing your affairs are in good hands if you’re unable to manage them.

- Avoiding court: Skips a potentially lengthy court process for decision-making.

- Personal choice: You get to pick who you trust as your attorney.

Creating an LPA Using Gov.UK:

The website provides two methods to create an LPA:

- Online Service: A user-friendly tool guides you through the process, lets you save your progress, and provides explanations. However, you’ll need to print and sign paper forms afterward.

- Paper Forms: Directly download and print forms from the website.

Key Steps in Creating an LPA:

- Choose Your Attorney: Pick someone reliable and trustworthy.

- Decide LPA Type: Select either health, financial, or both.

- Complete the Forms: Fill them online or on paper.

- Signatures and Witnessing: Gather signatures from attorneys, witnesses, and a certificate provider.

- Registration: Register the LPA with the Office of the Public Guardian (OPG) for activation.

Additional Resources on Gov.UK:

The website offers more resources, including:

- Detailed guides: Comprehensive explanations of the LPA process and different scenarios.

- Help options: Information on getting assistance if you lack certain tools or need guidance with the online service.

- Downloadable forms: Links to download LPA forms in various formats.

For more information, visit the Gov.UK LPA page: https://www.gov.uk/power-of-attorney

Remember: Consulting a solicitor can ensure your LPA suits your needs and complies with legal standards.

LPA Guide

Lasting Power of Attorney Health and Welfare

A Lasting Power of Attorney (LPA) for health and welfare is a legal document used in the UK that lets you designate someone you trust (known as an attorney) to make decisions regarding your medical care and overall well-being in case you are unable to do so due to mental incapacity. This ensures that your preferences are honored even when you cannot express them yourself.

What Decisions Can Your Attorney Make?

The LPA for health and welfare gives your attorney the authority to make various decisions related to your health and well-being, including:

- Medical Treatment: Giving consent to or refusing specific medical procedures, medications, or surgeries.

- Daily Living: Deciding on aspects of your daily routine like where you reside, who provides your care, and your dietary and clothing choices.

- End-of-Life Care: Making choices about your preferences for end-of-life care, such as pain management and resuscitation measures.

Benefits of an LPA for Health and Welfare:

- Peace of Mind: Knowing that your trusted person can make critical decisions about your care brings peace of mind to you and your family.

- Honors Your Preferences: The LPA ensures that your wishes regarding medical care and well-being are followed, even when you are unable to communicate them directly.

- Eases Family Burden: It relieves your loved ones from the burden of making tough decisions on your behalf during challenging times.

Creating an LPA for Health and Welfare:

- Eligibility: You must be at least 18 years old and possess mental capacity (understanding the document and its implications) to create an LPA.

- The Process: You can use the government’s online service or paper forms. Both options require signatures from your attorneys, witnesses, and a certificate provider. Finally, the LPA needs to be registered with the Office of the Public Guardian (OPG).

- Specifying Your Wishes: You can include detailed instructions in the LPA to guide your attorney’s decisions based on your values and preferences.

Important Considerations:

- Choosing Your Attorneys: Select someone trustworthy who comprehends your medical preferences and values your autonomy. Consider appointing a backup attorney if your primary choice is unavailable.

- Keeping it Current: You can review and update your LPA while you have mental capacity. Discuss any health or preference changes with your attorney to ensure the document reflects your current wishes.

- Communication is Essential: Maintain open and transparent communication with your loved ones and your attorney regarding your health care wishes.

An LPA for health and welfare empowers you to take charge of your future care and ensures that your desires are respected. By planning ahead and establishing an LPA, you enable your loved ones to make informed decisions on your behalf when the need arises.

Lasting Power of Attorney Cost

When creating a Lasting Power of Attorney (LPA) in the UK, there are two primary cost considerations to keep in mind:

- Registration Fee: This fee is charged by the Office of the Public Guardian (OPG) to register your LPA. As of March 2024, the fee is £82 for each type of LPA (health and welfare or property and financial affairs). If you register both types simultaneously, the total fee is £164.

- Optional Costs: Additional expenses you may encounter include:

- Solicitor Fees: Hiring a solicitor who specializes in LPAs can provide valuable guidance and ensure your LPA meets legal requirements. Fees can vary widely based on complexity and service level, ranging from a few hundred pounds to over £1,000.

- Digital LPA Service Fees: Some legal service providers offer paid digital LPA services that may streamline form completion, offer additional support, or provide a user-friendly interface. These services typically cost between £50 to £200.

Potential Costs Breakdown:

- DIY LPA (without solicitor): Registration fee (£82 per LPA) + Minimal printing costs.

- DIY LPA with government online tool: Registration fee (£82 per LPA) + Minimal printing costs.

- LPA with solicitor: Registration fee (£82 per LPA) + Solicitor fees (variable, ranging from a few hundred to over £1,000).

- LPA with paid digital LPA service: Registration fee (£82 per LPA) + Digital service fee (around £50 to £200).

Cost-Saving Tips:

- Consider DIY with Government Resources: Utilize the free resources and online tool provided by the government if you’re comfortable navigating the process independently.

- Compare Solicitor Fees: Obtain quotes from multiple solicitors to compare fees and services offered.

- Explore Discounts: Certain individuals on low incomes or receiving specific benefits may qualify for reduced or waived OPG registration fees. Check Gov.UK for eligibility criteria.

Remember: While there are initial costs associated with creating an LPA, it’s an investment in your future and ensures your wishes are honored. It also helps avoid potential complications or court proceedings if you’re unable to make decisions independently.

What is Lasting Power of Attorney?

A Lasting Power of Attorney (LPA) is a legal document in the UK that lets you designate a trusted person (known as an attorney) to make decisions on your behalf if you’re unable to do so due to illness, injury, or age-related incapacity. There are two primary types of LPAs:

- LPA for health and welfare: This allows your attorney to make choices regarding your medical care, daily living arrangements, and end-of-life preferences.

- LPA for property and financial affairs: This grants your attorney the authority to manage your finances, pay bills, and handle property matters according to your instructions.

Benefits of Having an LPA:

- Peace of Mind: Knowing your affairs are in capable hands provides peace of mind for both you and your family.

- Avoids Court Proceedings: An LPA eliminates the need for a lengthy and costly court process to appoint someone to act on your behalf.

- Choice and Control: You have the freedom to select an attorney you trust, ensuring your wishes are honored.

Creating an LPA:

- Eligibility: You must be 18 or older and mentally capable to create an LPA.

- The Process: The government offers two methods for LPA creation:

- Online Service: An easy-to-use tool guides you, but you’ll need to print and sign paper forms eventually.

- Paper Forms: Download and print forms directly from the government’s website.

- Key Steps: After completing the forms, get them signed by your attorneys, witnesses, and a certificate provider. Then, register the LPA with the Office of the Public Guardian (OPG) for activation.

Important Considerations:

- Choosing Attorneys: Pick someone trustworthy, responsible, and familiar with your wishes.

- Keeping it Current: You can update your LPA while you’re mentally capable.

- Seeking Professional Advice: Consulting a solicitor ensures your LPA is correctly crafted, reflects your wishes, and appoints suitable attorneys.

Understanding LPAs empowers you to plan for the future and ensures your loved ones can manage your affairs if necessary. By taking proactive steps and establishing a solid legal foundation, you can approach the future with greater peace of mind.

Lasting Power of Attorney Guidance

A Lasting Power of Attorney (LPA) is a crucial legal instrument in the UK, allowing you to nominate a trusted individual (your attorney) to make decisions on your behalf should you become mentally incapacitated. This guarantees that your preferences concerning your health, finances, and overall well-being are upheld. Below is a detailed guide to navigating the LPA process effectively:

Understanding the Types of LPAs:

- LPA for health and welfare: This enables your attorney to decide on your medical care, daily routines, and end-of-life wishes.

- LPA for property and financial affairs: This grants your attorney the authority to manage your finances, handle bills, and oversee your property as per your instructions.

Benefits of Creating an LPA:

- Peace of Mind: Knowing your affairs are in capable hands provides immense comfort to you and your loved ones.

- Avoids Court Procedures: An LPA negates the need for lengthy and expensive court processes to appoint a decision-maker on your behalf.

- Empowers Choice and Control: You have the liberty to designate someone you trust to act as your attorney, ensuring your wishes are honored.

Creating Your LPA:

- Eligibility: You must be at least 18 years old and possess mental capacity to comprehend the document’s implications.

- Government Resources: The UK government offers helpful resources and tools for creating an LPA:

- Online Service: This user-friendly tool guides you through the process step-by-step, allowing you to save progress. However, finalization requires printing and signing paper forms.

- Paper Forms: Directly download and print forms from the government website.

Completing the Forms:

- Carefully fill out the details whether using the online tool or paper forms.

- Designate Your Attorneys: Select trustworthy individuals to act as your attorneys, whether for health and welfare or property and financial affairs.

- Involve Witnesses and a Certificate Provider: Witness signatures and certification by a provider confirm your voluntary understanding of the LPA.

Registration is Key:

- After completion and signatures from all parties, submit the LPA to the Office of the Public Guardian (OPG) for registration.

- Registration is pivotal for legal validity and grants your attorneys the authority to act on your behalf. The process typically takes around 20 weeks.

Additional Considerations:

- Seek Professional Guidance: Consulting a solicitor specialized in LPAs ensures your LPA is tailored, legally sound, and appoints the right attorneys.

- Keep it Current: Regularly review and update your LPA while mentally capable.

- Maintain Open Communication: Communicate openly with your family and attorneys about your preferences regarding care and finances.

Resources for Creating Your LPA:

- Gov.UK LPA page: https://www.gov.uk/power-of-attorney

- Help with the LPA process: https://www.gov.uk/power-of-attorney

Remember: Creating an LPA is a responsible step to plan for your future and ensure your wishes are honored, even in incapacity. By understanding the process and utilizing available resources, you can make informed decisions and achieve peace of mind for yourself and your loved ones.

Lasting Power of Attorney Certificate Provider

A Lasting Power of Attorney (LPA) is a crucial legal tool in the UK, empowering you to appoint a trusted individual (your attorney) to act on your behalf if you’re unable to make decisions due to a lack of mental capacity. Central to the LPA process is the certificate provider, who plays a pivotal role in ensuring the LPA’s legitimacy under the correct circumstances.

Roles of a Certificate Provider:

The certificate provider acts as an impartial witness to confirm:

- Mental Capacity: They verify your understanding of the LPA document, its implications, and the authority granted to your attorney.

- Voluntary Decision: They ensure that you’re creating the LPA willingly and without any external pressure or coercion.

Types of Certificate Providers:

- “Knowledge-Based” Provider: This can be someone who has known you personally for at least two years, such as a friend, neighbor, colleague, or former colleague. They must be over 18 and grasp the nature of an LPA.

- “Skills-Based” Provider: These are professionals with expertise in assessing mental capacity, such as your General Practitioner (GP), Solicitor, Social Worker, or Independent Mental Capacity Advocate (IMCA).

Choosing the Right Certificate Provider:

Consider the following factors when selecting a certificate provider:

- Independence: Ensure they have no personal interest or bias in your affairs, your attorneys, or the LPA’s outcomes.

- Understanding: Pick someone knowledgeable about LPAs and the mental capacity criteria.

- Comfort: Select someone with whom you feel at ease discussing your situation.

Certification Process:

During the certification, the provider will meet with you individually to discuss the LPA, assess your mental capacity, and confirm your voluntary decision-making.

Additional Points to Note:

- Confidentiality: The certificate provider must maintain confidentiality unless concerns arise about your safety or well-being.

- Witnessing Rules: They cannot simultaneously act as your attorney or witness for your signature.

Remember: The certificate provider’s role is critical in ensuring your LPA is valid and truly reflects your intentions. Choose wisely, based on trust and understanding, to facilitate a smooth and legally sound LPA creation process.

Lasting Power of Attorney Meaning

A Lasting Power of Attorney (LPA) is a legal tool in the UK that lets you choose someone you trust (an attorney) to make decisions for you if you’re unable to do so due to illness, injury, or age-related issues.

Here’s a breakdown of what an LPA means and why it’s important:

Understanding the “Lasting” Aspect:

An LPA remains valid even if you lose mental capacity later on, unlike a regular power of attorney.

Types of LPAs:

There are two main types of LPAs, each giving your attorney specific powers:

- LPA for health and welfare: Allows decisions about your medical care, daily life, and end-of-life preferences.

- LPA for property and financial affairs: Empowers your attorney to handle your money, bills, and property based on your instructions.

Benefits of Having an LPA:

- Peace of Mind: Knowing your affairs are in trusted hands brings comfort to you and your family.

- Avoids Court Process: An LPA skips the lengthy and costly court process for appointing decision-makers.

- Choice and Control: You pick who you trust most to act on your behalf, ensuring your wishes are followed.

Creating Your LPA:

Eligibility: You must be 18 or older and mentally capable to understand the document. The Process: The UK government offers two methods:

- Online Service: Guides you through, but you’ll need to print and sign forms.

- Paper Forms: Directly downloadable from the government website.

Key Steps:

Once forms are done, they need signatures from your attorneys, witnesses, and a certificate provider. Then register with the Office of the Public Guardian (OPG) for activation.

Important Points:

- Choose Trusted Attorneys: Pick responsible individuals who understand your care and financial preferences.

- Keep it Current: Update your LPA as needed while you’re mentally capable.

- Seek Professional Advice: Consulting a solicitor ensures your LPA fits your needs, meets legal standards, and appoints the right attorneys.

Understanding an LPA’s significance helps you plan ahead, ensuring your loved ones can manage your affairs if you’re unable to. This legal safeguard provides peace of mind for your future.

FAQ

What is a Lasting Power of Attorney (LPA)?

A Lasting Power of Attorney (LPA) is a legal instrument utilized in England and Wales, enabling you to designate trusted individuals (referred to as your attorneys) to act on your behalf should you become mentally incapable, whether due to illness, injury, or age-related factors.

There exist two primary categories of LPAs:

- LPA for health and welfare: Grants your attorney authority over decisions concerning your medical treatment, daily living arrangements, and end-of-life preferences.

- LPA for property and financial affairs: Empowers your attorney to manage your financial matters, including bills, property, and following your instructions.

Advantages of having an LPA:

- Peace of mind: Knowing your affairs are in capable hands offers comfort to both you and your family.

- Avoidance of court proceedings: An LPA negates the need for a lengthy and costly legal process to appoint a decision-maker.

- Choice and control: You retain the ability to select attorneys you trust, ensuring your desires are honored.

Process of creating an LPA:

- Eligibility: You must be of sound mind and at least 18 years old to establish an LPA.

- Creation methods: The UK government provides two avenues for LPA creation: a. Online service: A user-friendly tool guides you through the process, though you’ll need to print and sign physical forms. b. Paper forms: Download and print the necessary documents directly from the official government website.

- Key post-form completion steps: a. Obtain signatures from your attorneys, witnesses, and a certificate provider. b. Register the LPA with the Office of the Public Guardian (OPG) for activation, typically taking around 20 weeks.

Essential considerations:

- Attorney selection: Choose individuals who are trustworthy, responsible, and familiar with your wishes.

- Regular updates: Keep your LPA current while you possess mental capacity.

- Professional advice: Consulting a solicitor can ensure your LPA aligns with your requirements and complies with legal standards.

What is the difference between power of attorney and Lasting Power of Attorney UK?

The key difference between a Power of Attorney (POA) and a Lasting Power of Attorney (LPA) in the UK lies in their validity when you lose mental capacity.

-

Power of Attorney (POA):

- A POA is a legal document that allows you to appoint someone (your attorney) to make decisions on your behalf for a specific purpose or period.

- Crucially, a standard POA becomes invalid if you lose mental capacity during that time.

-

Lasting Power of Attorney (LPA):

- An LPA, on the other hand, is specifically designed to address this limitation.

- It remains valid even if you lose mental capacity in the future, ensuring your attorney can still make decisions as per your wishes.

- This is particularly important for situations where you might become mentally incapable due to illness, injury, or age.

Here’s a table summarizing the key differences:

| Feature | Power of Attorney (POA) | Lasting Power of Attorney (LPA) |

|---|---|---|

| Validity when incapacitated | Becomes invalid | Remains valid |

| Purpose | Specific purpose or period | Long-term decisions |

| Use case | Short-term situations (e.g., vacation) | Long-term care, illness, etc. |

In essence, an LPA is a more comprehensive and future-oriented version of a POA. It offers peace of mind by ensuring your chosen attorney can make decisions on your behalf even if you’re no longer able to do so yourself.

How do I get Lasting Power of Attorney UK?

Getting a Lasting Power of Attorney (LPA) in the UK can be accomplished through two primary avenues:

- Utilizing the Government’s Online Service:

This option, provided by the UK government, is user-friendly and involves the following steps:

- Visit the Gov.UK LPA page at https://www.gov.uk/power-of-attorney.

- Choose the type of LPA: Decide whether you need an LPA for health and welfare or property and financial affairs (or both).

- Complete the online form: The website will guide you through the process step by step. You can save your progress and return later if needed.

- Print the forms: Once completed, the online service generates printable versions of the LPA forms.

- Obtain signatures:

- Your chosen attorneys must sign the forms.

- Two witnesses who are not named as attorneys must also sign.

- Finally, a certificate provider will verify your mental capacity and sign the form.

- Register the LPA: Send the completed and signed forms to the Office of the Public Guardian (OPG) for registration. There’s a fee associated with registration (currently £82 per LPA). It typically takes up to 20 weeks for the LPA to be registered.

- Using Paper Forms:

- Download the forms: You can directly download the LPA forms from the Gov.UK website.

- Fill out the forms: Complete the paper forms manually.

- Follow the same signature and registration process as outlined for the online service.

Here are some additional considerations:

- Choosing Your Attorneys: Select trustworthy individuals who understand your wishes and are comfortable making decisions on your behalf. You can appoint one or more attorneys for each LPA type.

- Keeping it Up-to-Date: You can review and update your LPA at any time while you have mental capacity.

- Professional Guidance: Consulting a solicitor specializing in LPAs can ensure your LPA is tailored to your needs and meets legal requirements. They can also advise on the process and potential complexities.

Remember: The government website provides a wealth of resources on LPAs, including detailed guides, information on getting help with the process, and downloadable forms.

How much does a Lasting Power of Attorney cost in the UK?

The expenses associated with obtaining a Lasting Power of Attorney (LPA) in the UK can be categorized into two primary components:

- Registration Fee: This fee is imposed by the Office of the Public Guardian (OPG) for registering your LPA. As of March 2024, the fee stands at £82 for each LPA type (health and welfare or property and financial affairs). If both types of LPAs are registered simultaneously, the total fee is £164.

- Optional Costs: Additional expenses you might encounter include:

- Solicitor Fees: Engaging a solicitor specialized in LPAs can offer valuable guidance and ensure the proper creation of your LPA to meet legal standards. Solicitor fees can vary based on the complexity of your circumstances and the level of service required, ranging from a few hundred pounds to over £1,000.

- Digital LPA Service Fees: While the government provides a free online tool for LPA creation, some legal service providers offer paid digital LPA services. These services may automate form completion, provide extra support, or offer a more user-friendly interface, typically costing between £50 to £200.

Below is a breakdown of potential costs:

- DIY LPA (without a solicitor): Registration fee (£82 per LPA) + Minimal printing costs

- DIY LPA with the government’s online tool: Registration fee (£82 per LPA) + Minimal printing costs

- LPA with a solicitor: Registration fee (£82 per LPA) + Solicitor fees (variable, ranging from a few hundred to over £1,000)

- LPA with a paid digital LPA service: Registration fee (£82 per LPA) + Digital service fee (around £50 to £200)

Cost-Saving Tips:

- Consider DIY with Government Resources: Utilize free resources and the online tool provided by the government to navigate the LPA creation process independently, saving costs.

- Compare Solicitor Fees: Obtain quotes from multiple solicitors to compare fees and services offered before making a decision.

- Explore Discounts: Certain individuals on low incomes or receiving specific benefits may qualify for reduced or waived OPG registration fees. Check the Gov.UK website for eligibility criteria.

Remember: While there are upfront costs associated with creating an LPA, it is an investment in your future and well-being. It ensures your preferences are honored and helps avoid potential complications or legal proceedings if you are unable to make decisions independently.

Does lasting power of attorney continue after death UK?

No, a Lasting Power of Attorney (LPA) in the UK does not persist after death. When the individual who established the LPA (referred to as the “donor”) passes away, the LPA automatically terminates. This implies that your attorney no longer has the authority to make decisions on your behalf.

Here’s a breakdown of what occurs with an LPA following death:

- Attorney’s Authority Ceases: The legal authority of your attorney to make decisions under the LPA ends immediately upon your death.

- Notification to the OPG: It is essential to inform the Office of the Public Guardian (OPG) about the donor’s passing. The OPG will then update their records and cancel the LPA. Typically, the executor or personal representative of the deceased can handle this notification.

- Transition to Executors or Administrators: The responsibility for managing the affairs of the deceased transitions to the executors or administrators named in their will (if one exists).

Additional Considerations:

- Importance of a Will: Having a valid will is crucial to ensure that your wishes regarding your estate and assets are carried out after your death.

- Enduring Power of Attorney (Scotland): It’s worth noting that Scotland has a similar legal document known as an Enduring Power of Attorney, which may have different rules regarding its validity after death.

Here are some resources for further information:

- Gov.UK – Lasting Power of Attorney: https://www.gov.uk/power-of-attorney

- Notification of Death: Public Guardian Practice Note: https://www.gov.uk/government/publications/public-guardian-practice-note-notification-of-death/public-guardian-practice-note-notification-of-death

By understanding how LPAs function and their limitations, you can ensure that your affairs are managed according to your preferences, both during your lifetime and after your passing.

Hello, I’m Inna Evdokimova, an IP Lawyer and Patent Attorney based in the United Kingdom. With a passion for intellectual property law, I specialize in providing expert guidance and legal representation to clients navigating the complexities of patent law in the UK.

With years of experience in the field, I’ve cultivated a deep understanding of the intricacies of intellectual property rights, empowering individuals and businesses alike to protect their innovations and creations effectively.

Through my website, powerofattorneyuk.uk, I aim to serve as a valuable resource for those seeking clarity and assistance in matters of patent law and intellectual property rights. Whether you’re looking to secure a patent for your invention or require guidance on IP-related legal issues, my mission is to provide you with personalized, reliable solutions tailored to your unique needs.

I’m dedicated to helping my clients safeguard their intellectual property assets and navigate the legal landscape with confidence. With a commitment to excellence and client satisfaction, I strive to deliver results-driven strategies and advocacy that exceed expectations.

I look forward to the opportunity to assist you on your intellectual property journey and help you unlock the full potential of your innovations.