Power of Attorney Form UK [Free Download]

A Power of Attorney (POA) is like giving someone permission to make decisions for you when you can’t. The person you give this power to is called your agent or attorney-in-fact. Depending on the type of POA you have, your agent can do things like manage your money, make healthcare choices, deal with legal stuff, or handle property matters. Having a Power of Attorney is very important for a few key reasons.

First, it helps people plan for unexpected situations like being sick or not able to make decisions. By picking someone they trust to be their agent through a POA, they make sure their stuff gets taken care of the way they want even if they can’t talk or decide.

Second, a POA makes it easier to make choices, especially when things get complicated legally or financially. For instance, if someone travels a lot or lives in another country, they can choose an agent to handle their business there, which saves them time and trouble.

Also, a POA is super helpful for planning what happens to your stuff after you’re gone. It lets you pick someone to handle your money, health choices, and important decisions if you’re not around or can’t do it yourself.

There are different kinds of Power of Attorney, and they each give different levels of power to the person you choose to make decisions for you. A General Power of Attorney gives a lot of power to your chosen person, so they can handle many different things for you, like managing money and dealing with legal stuff.

Free Power Of Attorney UK Printable

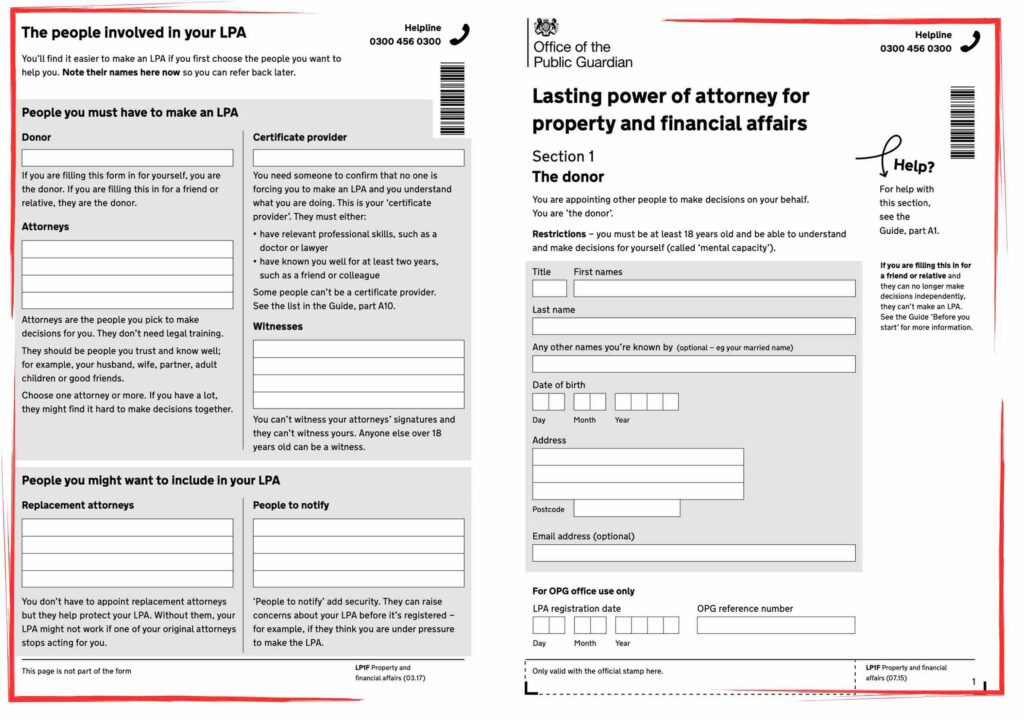

Lasting Power of Attorney Financial Decisions

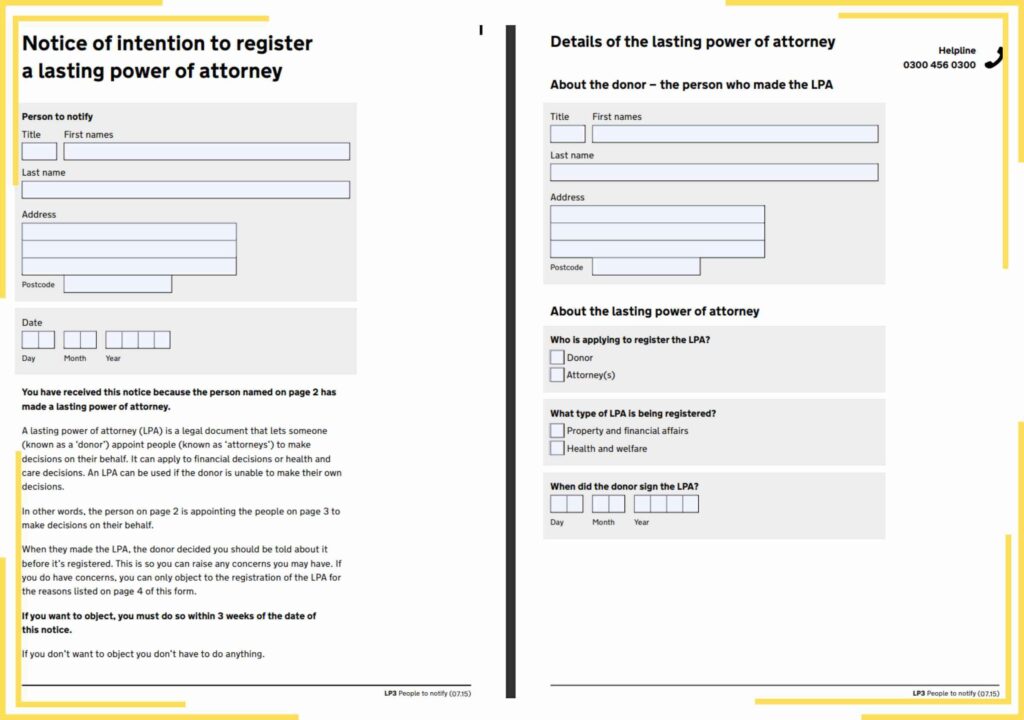

Power of Attorney Form To Notify People

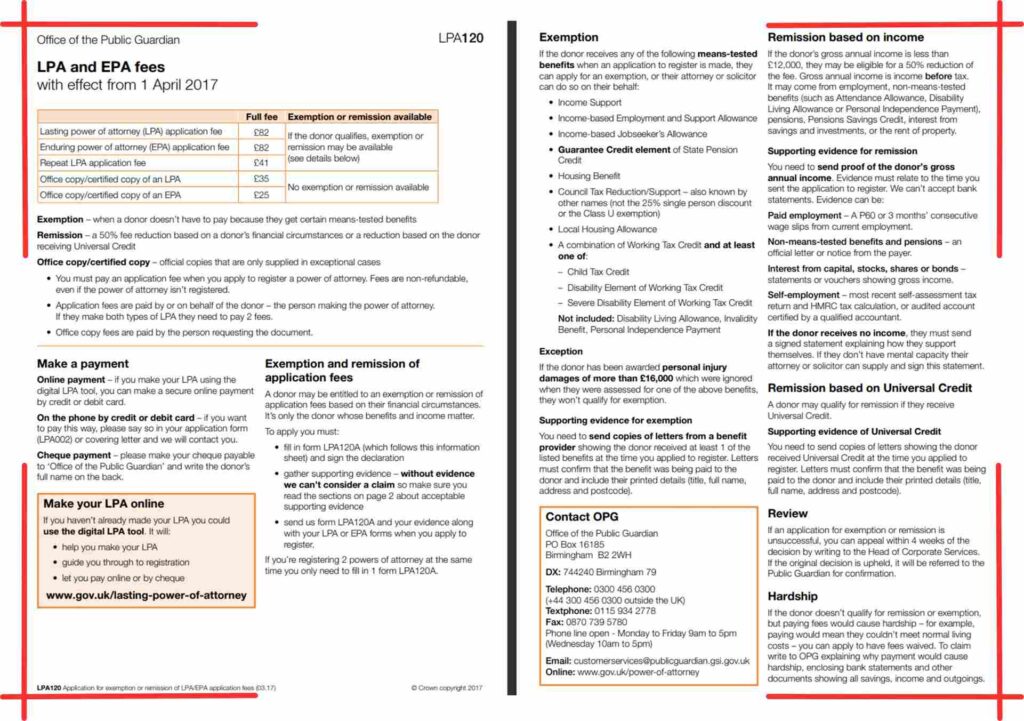

Power of Attorney and EPA Fees

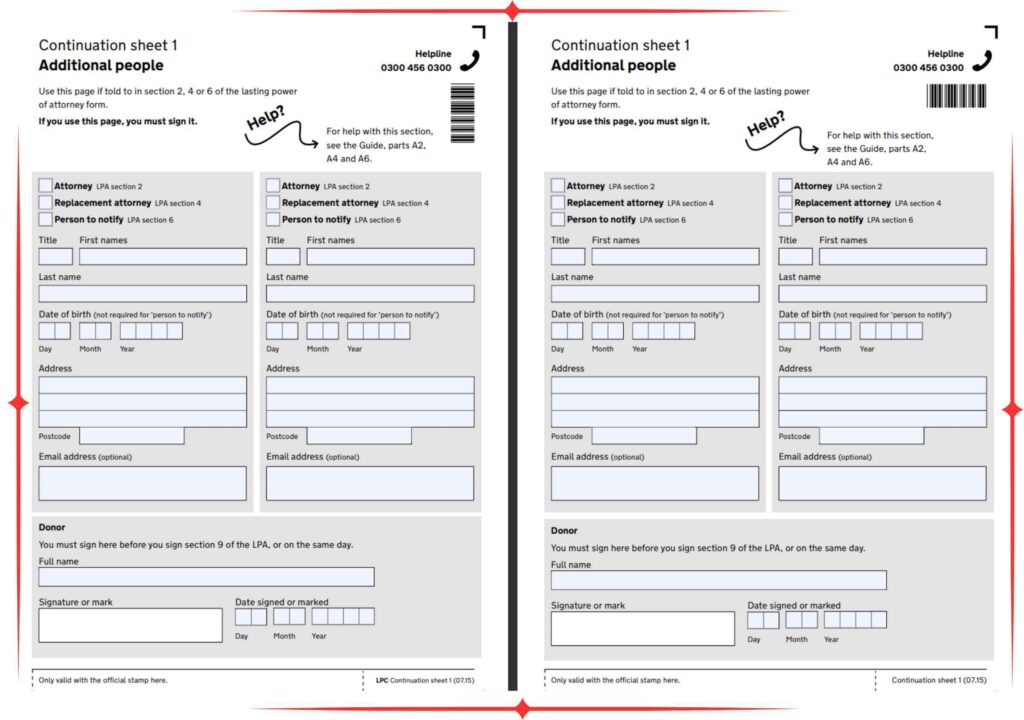

Power of Attorney Continuation Sheets

Power of Attorney Health and Care Decisions

Power Of Attorney Form

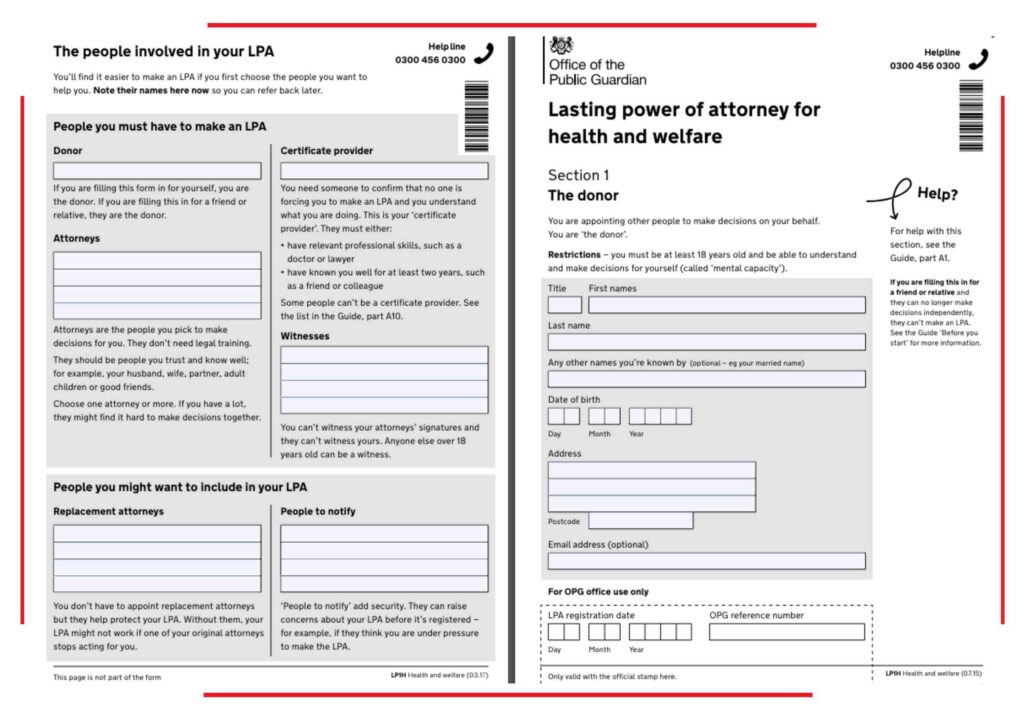

Lasting Power of Attorney Health and Care Decisions

What is Power of Attorney?

A Power of Attorney (POA) is a legal paper that lets someone else, known as the agent or attorney-in-fact, act on your behalf in certain situations. In simple terms, it means giving them the ability to make decisions and do things as if they were you.

Here are some important things to know about POAs:

- Control: With a POA, you get to decide what powers you’re giving to your agent. It can be very specific, like only for one task or type of decision, or it can be more general, letting them handle a range of things for you.

- Incapacity: POAs are often used when you might not be able to make decisions for yourself, like if you’re sick or injured. By choosing someone you trust as your agent, you make sure your affairs are still taken care of.

- Types of POA: There are different kinds of POAs for different purposes. For example, there are financial POAs for money matters, healthcare POAs for medical choices, and durable POAs that stay valid even if you can’t make decisions anymore.

To understand POA better, think of it like giving a spare key and instructions to a friend to look after your house while you’re away on a long trip. You’re giving them limited authority (access to the house) for a specific reason (taking care of it), similar to how a POA works.

Type of Power of Attorney in UK

In the UK, if you ever can’t make important decisions because of illness, injury, or age, a Power of Attorney (POA) can help manage your affairs smoothly. But since there are different types of POAs in the UK, it’s important to know their differences. Here’s a breakdown of the three main types:

- Lasting Power of Attorney (LPA):

- Introduced in 2007, LPAs are common in the UK and allow someone you trust to make decisions in two areas: a. Property and Financial Affairs LPA: This lets your chosen person handle your money matters. b. Health and Welfare LPA: This gives them authority over your medical care decisions.

Key benefits of LPAs:- Flexibility: You can have separate LPAs for different areas or combine them into one.

- Specificity: You can set limits on what your chosen person can do.

- Durability: An LPA stays valid even if you can’t make decisions later, as long as it was made when you could.

- Introduced in 2007, LPAs are common in the UK and allow someone you trust to make decisions in two areas: a. Property and Financial Affairs LPA: This lets your chosen person handle your money matters. b. Health and Welfare LPA: This gives them authority over your medical care decisions.

- Enduring Power of Attorney (EPA):

- No longer created since 2007, existing EPAs are still valid but are only for financial decisions.

- They end if you lose mental capacity.

- Ordinary Power of Attorney (OPA):

- Simplest type, usually for short-term needs like selling a car.

- Ends if you lose mental capacity.

Also, Check:

- Lasting Power Of Attorney Forms

- Power of Attorney For Health And Welfare

- Enduring Power of Attorney

- Government Power of Attorney

Choosing the Right POA:

- For ongoing finances, use an LPA for Property and Financial Affairs.

- For short-term needs, an OPA might work.

- For healthcare decisions, use an LPA for Health and Welfare.

Important Considerations:

- Pick a trustworthy attorney.

- Consult a solicitor to make sure your POA is done right.

- The Office of the Public Guardian is a useful resource for LPA information.

Understanding these POA types in the UK helps you make smart choices about managing your affairs, even when you can’t do it yourself.

Check about: Power of Attorney Cost

How To Get Power of Attorney?

Getting a Power of Attorney (POA) can be different depending on where you are and the type of POA you need. Here are the general steps for getting one in the United States:

- Decide on the Type of POA:

- Financial POA: Lets someone handle your money matters.

- Healthcare POA: Gives authority over medical decisions.

- General POA: Covers both financial and healthcare matters.

- Springing POA: Starts when you’re unable to make decisions.

- Durable POA: Stays valid even if you can’t decide later (most common in the US).

- Choose Your Agent:

- Pick someone trustworthy and capable of managing your affairs.

- Talk to them about your wishes and expectations.

- Get the POA Form:

- You can find forms online, through legal aid, or at office supply stores.

- It’s wise to get legal advice to ensure the form is right and reflects your wishes.

- Fill Out the Form:

- Carefully fill in your name, the agent’s name, and what powers you’re giving.

- In most states, two neutral witnesses need to sign, and some states may require notarization.

- Sign and File (Optional):

- Signing is usually recommended for clarity.

- You might want to file the POA with banks or healthcare providers, but it’s not always necessary.

Other Things to Know:

- Laws about POAs can differ by state, so it’s good to consult with a lawyer.

- An attorney can help you understand the process, create a custom POA, and make sure it’s legal.

Remember: A Power of Attorney is a big deal legally. Taking the time to learn about it and getting legal help can make sure your POA is done right and matches what you want.

I Have Power of Attorney Now What?

Congratulations on being appointed as someone’s Power of Attorney (POA)! It shows the trust they have in you to handle their affairs. Now, what do you do next? Here’s a guide to help you navigate your responsibilities as an attorney-in-fact:

- Understand the POA Document:

- Scope of Authority: Read the POA document carefully to know what decisions you can make on behalf of the principal. Does it cover finances, healthcare, or both? Are there any limits or specific instructions?

- Effective Date: Check when the POA becomes effective. Does it start right away, or only when the principal can’t decide for themselves?

- Communication and Respect:

- Open Communication: Keep the principal informed and discuss important decisions with them.

- Respecting Wishes: Always act in the principal’s best interests and follow their wishes as stated in the POA.

- Organize and Inventory:

- Gather Information: Get details about the principal’s finances, assets, and debts.

- Inventory: If managing their property, create a list of their belongings for insurance or future decisions.

- Financial Management (if applicable):

- Accounts: Open separate bank accounts if allowed by the POA. Keep clear records of money in and out.

- Bill Payments: Make sure bills are paid on time and handle their financial responsibilities carefully.

- Healthcare Decisions (if applicable):

- Medical Records: Know the principal’s medical history and preferences. Discuss with their doctor and have access to medical records.

- Directives: Understand any living will or healthcare directive they have and follow their wishes.

- Record Keeping:

- Maintain Records: Keep track of all actions and decisions made for the principal. Keep receipts and financial info organized.

- Transparency: Be ready to share records if asked, showing transparency and responsibility.

- Seek Guidance (if needed):

- Complexities: If things get tricky, get advice from a financial advisor or lawyer.

- Boundaries and Self-Care:

- Set Boundaries: Don’t overextend yourself. Take care of your well-being to avoid stress.

- Self-Care: Looking after yourself ensures you can handle the role effectively.

Remember: Being an attorney-in-fact is a big responsibility. Understand your duties, communicate well, and act in the principal’s best interests to fulfill your role confidently.

Who Can Override A Power of Attorney UK?

In the UK, a Lasting Power of Attorney (LPA) is the most common type of Power of Attorney and cannot be easily overridden. However, there are circumstances where the authority of an attorney appointed through an LPA can be contested or revoked. Here’s a breakdown of who can potentially limit an attorney’s powers:

- The Donor (if mentally capable):

- The person who made the LPA, known as the donor, can revoke it anytime if they are mentally capable. They can do this by: a. Formally Revoking: Completing and submitting a deed of revocation form to the Office of the Public Guardian (OPG). b. Destroying the Original LPA: Destroying the original document cancels the LPA.

- The Court of Protection:

- The Court of Protection oversees matters concerning individuals without mental capacity. It may intervene and restrict an attorney’s powers if: a. Misuse of Power: The attorney isn’t acting in the donor’s best interests or is misusing their authority. b. Lack of Capacity: The attorney loses mental capacity and can’t fulfill their duties. c. Serious Concerns: There are significant concerns about the donor’s safety due to the attorney’s actions.

- Other Parties (in specific cases):

- Certain individuals may raise objections about an attorney’s actions: a. Named Individuals in the LPA: If the LPA specifies people who can object to certain decisions made by the attorney. b. Public Bodies: Authorities like social services or healthcare providers may report suspected abuse or neglect to the Court of Protection.

For further information, you can refer to these resources:

- Office of the Public Guardian: https://www.gov.uk/government/organisations/office-of-the-public-guardian

- Citizens Advice: https://www.citizensadvice.org.uk/family/looking-after-people/managing-affairs-for-someone-else/

Remember: An LPA aims to protect the donor’s interests. If you have concerns about an attorney’s conduct, seek legal advice or report suspected wrongdoing to the appropriate authorities.

FAQ

A Power of Attorney (POA) is a legal paper that authorizes someone you trust (referred to as the agent or attorney-in-fact) to act on your behalf (known as the principal). Depending on your preferences, the agent can have wide-ranging authority to manage various matters or limited authority for specific tasks. This arrangement can be beneficial when you’re unable to be present, lack the capacity to decide, or prefer someone else to handle certain matters.

There are different types of POAs, such as:

- Financial Power of Attorney: Allows the agent to handle your finances, pay bills, and manage money matters.

- Healthcare Power of Attorney: Empowers the agent to make medical decisions on your behalf if you’re unable to do so.

- Durable Power of Attorney: Remains valid even if you become incapacitated.

- Special Power of Attorney: Grants authority to the agent for a particular task or matter.

Choosing a trustworthy agent is crucial, and it’s advisable to seek legal assistance in drafting the POA document. This ensures that the document aligns with your needs and complies with state laws.

In the UK, a Lasting Power of Attorney (LPA) must have several signatures to be legally valid:

- The Donor: This is the person creating the LPA and granting someone else the authority to act on their behalf. The Donor signs the document first.

- The Attorneys: These are the individuals appointed by the Donor to make decisions as outlined in the LPA (such as healthcare or financial matters). The Attorneys can sign the document in any order after the Donor.

- The Certificate Provider: This individual confirms that the Donor understands the LPA and hasn’t been pressured to sign it. Their signature doesn’t require a witness.

- The Witnesses: Each Attorney signing the LPA must have their signature witnessed by an impartial person. This witness cannot be a beneficiary of the LPA or related to the Donor or Attorneys.

In the UK, there are two primary types of Powers of Attorney with varying validity periods:

- Lasting Power of Attorney (LPA): This is currently the most common type. Once registered with the Office of the Public Guardian, an LPA remains valid indefinitely unless specific circumstances change. These circumstances include:

- The Donor (the person who created the LPA) passing away.

- The Donor revoking the LPA while they still have mental capacity.

- An attorney named in the LPA losing mental capacity.

- Specific situations, such as the Donor’s spouse/civil partner acting as attorney and experiencing a separation (unless the LPA states otherwise).

- Enduring Power of Attorney (EPA): These are no longer created, but some existing EPAs may still be valid. An EPA for property and financial affairs remains effective until the Donor passes away or revokes it. However, it becomes invalid if the Donor loses mental capacity.

The Powers of Attorney Act 2023 is the relevant legislation in the UK concerning Powers of Attorney. It became effective on September 18th, 2023, with certain provisions anticipated to be enforced later in 2024.

This Act primarily focuses on Lasting Powers of Attorney (LPAs), which serve as the main method to designate someone to act on your behalf in the UK. Here are key highlights of the Act:

- Digital LPAs: The Act introduces the option of creating LPAs electronically to streamline the process. However, a traditional paper-based method will remain available.

- Simplified ID Checks: The Act proposes simplifying the identification verification process for LPAs, which could alleviate burdens for legal professionals.

- Emphasis on Donor Choice: The Act upholds the principle that the LPA creator (donor) retains the right to choose their attorneys, even if those choices may appear unconventional.

It’s crucial to acknowledge that the Act is relatively new, and certain aspects like the digital LPA procedure are still being implemented. If you’re contemplating creating an LPA, seeking advice from a solicitor specializing in this field can provide you with the most up-to-date information and guidance.

In the UK, a Lasting Power of Attorney (LPA) cannot be directly overridden, particularly a Lasting Power of Attorney. Nonetheless, there are avenues through which it can be contested or terminated:

- The Donor: The individual who established the LPA (the Donor) holds significant authority in this scenario. If the Donor retains mental capacity, they have the right to revoke the LPA at any time.

- The Office of the Public Guardian (OPG): This institution has the capability to investigate any concerns regarding an attorney’s misuse of their powers. If substantiated evidence of wrongdoing is found, the OPG can take measures to remove or restrict the attorney’s authority.

- The Court of Protection: This court holds ultimate jurisdiction over LPAs. It possesses the authority to review decisions made by an attorney and can revoke the LPA entirely, particularly in cases involving abuse or actions not aligned with the Donor’s best interests.

Specific circumstances where an LPA might face challenge include:

- The Attorney prioritizing their own interests over the Donor’s.

- The Attorney lacking mental capacity to act on behalf of the Donor.

- The LPA being established through fraudulent means or undue pressure on the Donor.

It’s essential to note that those with the ability to raise concerns include:

- The Donor (if they retain mental capacity).

- Individuals listed in the LPA for notification purposes.

- Relatives of the Donor.

- The Local Authority.

Should you harbor concerns regarding the misuse of an LPA, seeking legal counsel is imperative to determine the most appropriate course of action.

In the UK, a Lasting Power of Attorney (LPA) typically does not necessitate notarization for its validity. The primary aspects of validity revolve around witness signatures and proper registration:

- Witness Signatures: Each attorney designated in the LPA must have their signature witnessed by an impartial individual. This witness should not have any vested interest or familial relationship with the parties involved.

- Registration: Following the signing process, the LPA must be registered with the Office of the Public Guardian (OPG) to become operational.

However, certain circumstances may warrant notarization:

- Using an LPA Internationally: If you intend to utilize an LPA in another country, it may necessitate notarization and an apostille (a certificate authenticating the notary’s seal and signature).

- Complex LPA Cases: In situations where a solicitor assists in crafting a complex LPA, notarization might be recommended for additional assurance.

It’s advisable to seek guidance from a legal professional specializing in LPAs if you have any uncertainties or require an LPA for international purposes.

There are two primary ways to classify Powers of Attorney (POA):

- By Scope of Authority:

- General Power of Attorney: Grants the agent broad authority to handle various financial and legal matters on your behalf. This should be approached cautiously due to the extensive powers it confers to your agent.

- Limited or Special Power of Attorney: Restricts the agent’s authority to specific tasks or decisions. For instance, you could establish a limited POA for someone to handle the sale of a particular property or manage a specific investment account.

- By Durability:

- Durable Power of Attorney: Remains effective even if you become incapacitated, ensuring continuity in decision-making if you’re unable to make decisions for yourself due to accident or illness.

- Non-Durable Power of Attorney (Springing Power of Attorney): Only becomes operational when a specific event occurs, such as your incapacitation. This can be beneficial if you wish to delay granting someone power of attorney until a particular circumstance arises.

Furthermore, there are specialized types of POAs commonly utilized for healthcare and financial matters:

- Medical Power of Attorney (Healthcare Power of Attorney): Empowers someone to make medical decisions on your behalf if you’re unable to do so due to illness or injury.

- Financial Power of Attorney: Authorizes someone to manage your financial affairs, including bill payments and money management.

It’s essential to note that the specific types of POAs and their legal intricacies may vary depending on your location. It’s advisable to seek legal counsel to determine the most suitable type of POA for your individual situation.

An agent appointed under a Power of Attorney (POA) holds several significant responsibilities towards the principal (the individual granting the power). These responsibilities are outlined as follows:

- Act in Good Faith and Best Interests: The agent must consistently act with honesty and prioritize the principal’s best interests in every decision. This entails refraining from actions that may benefit the agent personally or contradict the principal’s directives.

- Adhere to POA Limits: The agent’s authority is strictly defined by the terms outlined in the POA document. They are prohibited from surpassing these boundaries or engaging in activities beyond the scope of the POA.

- Duty of Care: The agent is obligated to exercise reasonable care and caution when handling the principal’s matters. This involves making prudent decisions based on available information and avoiding unnecessary risks.

- Maintain Transparency and Communication: The agent should maintain open communication with the principal, particularly regarding financial matters. This may include providing regular updates or account statements and informing the principal about significant decisions.

- Record Keeping: It is the agent’s responsibility to maintain accurate and comprehensive records of all transactions and decisions made on behalf of the principal. These records serve as vital documentation in case inquiries arise regarding the agent’s actions.

- Avoid Conflicts of Interest: The agent should steer clear of situations that create a conflict between their personal interests and the principal’s interests. If such a conflict arises, the agent must disclose it to the principal and consider stepping down from their role.

- Loyalty: The agent owes a duty of loyalty to the principal, which entails refraining from utilizing their position for personal gain or unlawfully benefiting from the principal’s assets.

It’s important to note that these responsibilities are general guidelines, and the specific duties of an agent can vary based on the type of POA and local laws. Seeking legal guidance when establishing a POA is advisable to ensure both the principal and agent comprehend their rights and obligations thoroughly.